Financial Blog

Latest

EQUITY EXOTIC RISKS SERIES : DISPERSION

A single-stock exotic trader who sells...

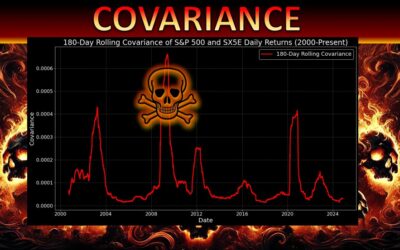

𝗘𝗤𝗨𝗜𝗧𝗬 𝗘𝗫𝗢𝗧𝗜𝗖 𝗥𝗜𝗦𝗞𝗦 𝗦𝗘𝗥𝗜𝗘𝗦: 𝗖𝗢𝗩𝗔𝗥𝗜𝗔𝗡𝗖𝗘

The life of an exotic trader often involves...

𝗘𝗤𝗨𝗜𝗧𝗬 𝗘𝗫𝗢𝗧𝗜𝗖 𝗥𝗜𝗦𝗞𝗦 𝗦𝗘𝗥𝗜𝗘𝗦: 𝗗𝗜𝗩𝗜𝗗𝗘𝗡𝗗𝗦

As almost every structured product issued...

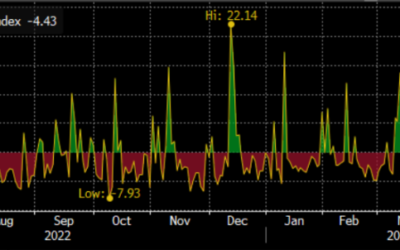

US Presidential Election, VIX and OPTION MARKET

On Monday, October 7, the 𝗩𝗜𝗫 𝗷𝘂𝗺𝗽𝗲𝗱 𝗯𝘆 𝟯...

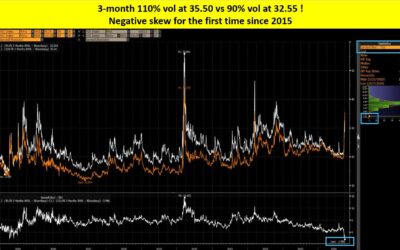

ATTENTION: NEGATIVE SKEW ON HANG SENG INDEX

The rush into Chinese equities has propelled the...

The 2024 Outlook on Korean Autocallables and the HSCEI $5 Billion Digital: A Deep Dive

The Rising Tide of South Korea's Structured...

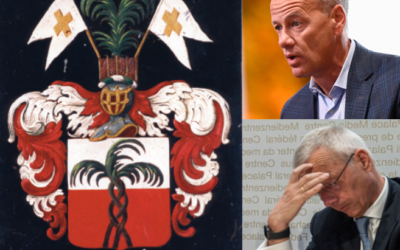

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember...

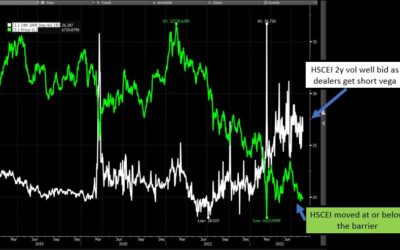

HSCEI TV : How Structured Products Distort Volatilities

In the world of structured products, and as...

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for...

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a...

Roche…. getting closer to the cliff edge

The Q3 results of Roche disappointed the market....

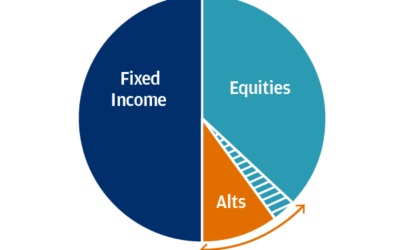

Structured Products = Alternative Investments ?

Asset managers tend to classify structured...

Is Optimising Structured Products Really Optimal ?

Banks and independent software companies offer...

Structured Product Blues

Yield enhancement products have been the market...

What To Expect From VIX1D, The New One-Day VIX?

This week, another VIX was launched by CBOE: the...

MOVE vs VIX Ratio: Is That A Relevant Metrics ?

The Move/VIX Ratio is now very fashionable...

Decrement Indices: You Are Warned!

The Central Bank of Ireland reiterates its...

Gentlemen: How Should You Split The Bill?

Here is a question that divides etiquette...

Credit Suisse takeover? Silicon Valley Bank Bankruptcy?.. Been There, Done That.

The 2023 financial saga with Silicon Valley Bank...

The 2Y USD Black Swan… Not Tonight Josephine!

Empress Josephine, Napoleon's wife, was...

0DTE Options Are Not Lottery Tickets, They Are Worse Than That!

There is more and more noise about the rise...

Nestlé, Roche, Novartis : Swiss curse or Swiss blessing?

Being a structurer is a great job: it means...

Who Does Not like Volatility Laundering?

🏆 Private Equity firms reported 1.6% gains for...

The VKO Puts Makes Citi Equity Derivatives House Of The Year 2022

🏆 Citi has been named Equity Derivatives House...

𝗧he 𝗛alf 𝗕illion 𝗗ollar 𝗖hinese 𝗗igital

The South Korean Financial Supervisor has...

Will The USA Default ?

The debt ceiling of the USA is not yet the focus...

European Barrier Or American Barrier ?

When investing into a Barrier Reverse...

It’s This Time Of the Year Again: Outperformance certificates

By now, most Swiss wealth managers will have...

When Did the 60/40 Portfolio Start Failing?

The year 2022 has been named the year of the...

The 60/40 Portfolio and Structured Products: Are Autocallables Equity or Bond?

Investors...

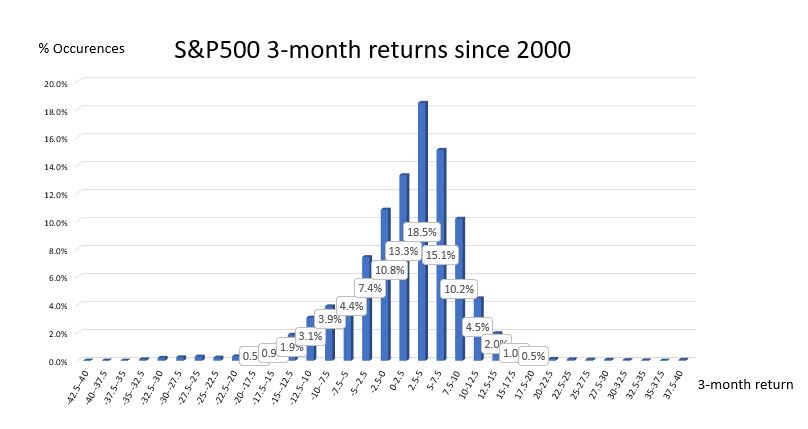

The Dieter’s Paradox: When Adding More Risks Feels Safer

Take a portfolio made 100% of Moderna shares....

What Will Stop The S&P Spot Down/Vol Down Dynamics (resp. up/up)?

One of the main features of the year 2022 is the...

How a EUR/USD TARF Turned Sour And Put An Italian Corporate At Risk

According...

Will The Winter Be Colder In Germany ?

This year the stock market has told us that...

S&P500 vs US Stocks: The Story Of Two Skews

Singles Skew Up Structured products on US...

Spot Down / Vol Down

"Spot down / Vol down" is the name of the game...

Where Has S&P500 Skew Gone?

Many things have collapsed this year but for vol...

The Risks of the Vol KO Put

Recently we have looked at the benefit of the...

Volatility KnockOut Puts : Pay For The Way The Market Is (Not) Moving

We wrote recently about the temptation of the...

The Temptation of the 95% Strike Put

Investors are always reluctant to buy puts to...

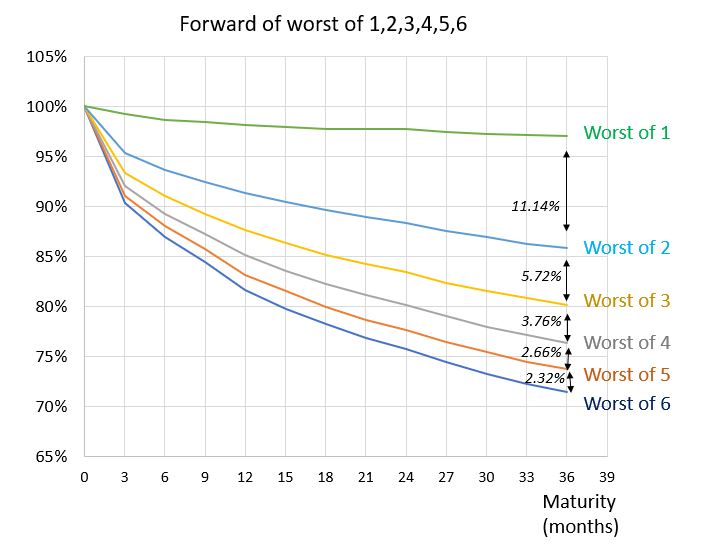

Worst of 2…3…4…5? How many are too many?

The industry practise is to build BRCs or...

Are Best Of Puts The Worst Hedges ?

Investors do no like to lose money when the...

Spread VIX versus V2X

The spread V2X (European VIX) and VIX is...

SX5E Dividends: Beware The Ides Of March ! 2022 vs 2020

Mid-March 2020 was a turning point for...

VXX Is Closed And That Is Good News

Last week, Barclays announced that it has...

The Collapse Of HSCEI And Its Impact For Investors And Banks

The HSCEI Index (Hang Seng China Enterprise...

Is Thematic Investing Performing ?

Thematic investing has been one of the greatest...

The Barrier Reverse Convertible

The Barrier Reverse convertible is one of the...

The Reverse Convertible

The Reverse convertible is the simplest and...

Decrement indices and Autocallables : the good, the bad and the ugly.

For investors looking for yield, autocallables...

Is the VIX useless?

The VIX (for Volatility Index) is an index...

An in-depth look into palladium / spot dispersion trades

Spot dispersion or Palladium products have...

Structured products and the dividend rout of 2020: where did it go wrong?

Sharp declines in value across asset classes...

Markets

ATTENTION: NEGATIVE SKEW ON HANG SENG INDEX

The rush into Chinese equities has propelled the 𝗛𝗮𝗻𝗴 𝗦𝗲𝗻𝗴 𝗜𝗻𝗱𝗲𝘅 𝗯𝘆 +𝟯𝟱% over the last month! 𝗧𝗵𝗮𝘁 𝗿𝘂𝘀𝗵 𝗺𝗮𝗻𝗶𝗳𝗲𝘀𝘁𝘀...

The 2024 Outlook on Korean Autocallables and the HSCEI $5 Billion Digital: A Deep Dive

The Rising Tide of South Korea's Structured Products Market In the heart of Asia's financial innovation, South Korea...

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica...

Derivates

𝗘𝗤𝗨𝗜𝗧𝗬 𝗘𝗫𝗢𝗧𝗜𝗖 𝗥𝗜𝗦𝗞𝗦 𝗦𝗘𝗥𝗜𝗘𝗦: 𝗖𝗢𝗩𝗔𝗥𝗜𝗔𝗡𝗖𝗘

The life of an exotic trader often involves selling cheap calls and buying expensive puts. A strategy to make the put...

𝗘𝗤𝗨𝗜𝗧𝗬 𝗘𝗫𝗢𝗧𝗜𝗖 𝗥𝗜𝗦𝗞𝗦 𝗦𝗘𝗥𝗜𝗘𝗦: 𝗗𝗜𝗩𝗜𝗗𝗘𝗡𝗗𝗦

As almost every structured product issued globally is bullish, the flow from retail investors is essentially "long...

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica...

Products

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a reality. According to The Korea Times, South Korea's Financial...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a competence? or a promise for future underperformance ? Regarding...

Structured Products = Alternative Investments ?

Asset managers tend to classify structured products as “alternatives”. That is rather a classification by default than...

Other posts

The 2024 Outlook on Korean Autocallables and the HSCEI $5 Billion Digital: A Deep Dive

The Rising Tide of South Korea's Structured Products Market In the heart of Asia's financial innovation, South Korea...

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica...

HSCEI TV : How Structured Products Distort Volatilities

In the world of structured products, and as mentionned in a previous post, 2024 will be an extraordinary year in South...

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of...

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a reality. According to The Korea Times, South Korea's Financial...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a competence? or a promise for future underperformance ? Regarding...

Roche…. getting closer to the cliff edge

The Q3 results of Roche disappointed the market. At 11:00am the spot is down 4.70%... The stock is now down 19% YTD...

Structured Products = Alternative Investments ?

Asset managers tend to classify structured products as “alternatives”. That is rather a classification by default than...

Is Optimising Structured Products Really Optimal ?

Banks and independent software companies offer optimisers / optimizers for structured products It is quite standard...