Banks and independent software companies offer optimisers / optimizers for structured products

It is quite standard now for banks and software providers to offer an “optimiser” for structured products. Concretely, out of a universe of N stocks that you select, the optimiser comes up with the combinations of say 3 stocks that optimise the optics of the product: when optimising a BRC or an autocall, the optimiser will show you the combinations that give you the highest coupons or the lowest barriere. Some can do that in a handful of seconds, which is really impressive.

For the distributors, the benefits of the optimizer are obvious

For the distributor, the appeal is obvious. You were looking on a worst of A, B, C? Why not considering a worst of A, B, D , and get 4% higher coupon? You want exposure on the retail industry? let me find you the 3 stocks that will give you the highest possible combination! It facilitates dialogue, new ideas, trades and fees!

For the trader… Naturally, the optimiser will pick the stocks with the highest dividends, the highest volatility and the highest skew. The correlation is secondary at this stage. So if all traded products were optimised, the trader would systematically buy vega on high vol names, buy high dividends, buy high skew, which is not what he would dream of! Additionally otpimisers have the talent of picking up stocks whose parameters are marked too agressively… making it more likely to trade on mismarks.

Does the end client really benefit from optimizers and is he/she explained the inherent additional risks?

What about the client? For sure he will get a higher coupon, at the cost of

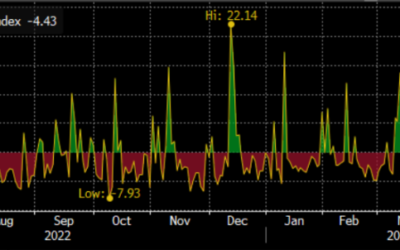

a higher implied volatility: implied volatility being a good indicator of future realised volatility, it means that the mark-to-market of the “optimised” product will be more volatilite than the non-optimised product. But that’s the fair counterpart to a higher coupon!

A higher dividend. A higher dividend will be deducted from the final performance of the stock, but that’s compensated by a higher coupon. Unfortunately, implied dividends trade at a discount versus realised (especially the large ones), so in general the investor will not be compensated enough but this higher dividend.

A higher skew. Strictly speaking a higher skew implies that if the underying goes down, the volatility will go up more, but here again that is compensated by the higher coupon. But here comes a little concern, Xing, Zhang and Zhao (2010) found that stocks with the highest skew tend to underpeform. They actually underperform low skew stocks by 10% per annum!

If the benefits of an optimisation are obvious, the risks associated (a higher volatilitiy of the mark-to-market and a likley underperformance) has to be remembered!

Xing, Y., Zhang, X., & Zhao, R. (2010). What does the individual option volatility smirk tell us about future equity returns?. Journal of Financial and Quantitative Analysis, 45(3), 641-662.