This week, another VIX was launched by CBOE: the VIX1D. it is meant to measure the 1-day volatility of S&P500. The popularity of 0DTE options on S&P500 (40% of the traded options nowadays!) naturally lead CBOE to laucnhe the new index. The formula that gives the value of the VIX1D is the same as for VIX: It is the average of the mid options prices (calls and puts) weighted by the inverse of the squared strike. There is an additional technicality as the day passes as the formula then switches to options expiring on the next day so the duration of that formula remains rougly one day at all time. Let’s forget at that technicality for a moment.. and rather focus on what to expect of that VIX1D.

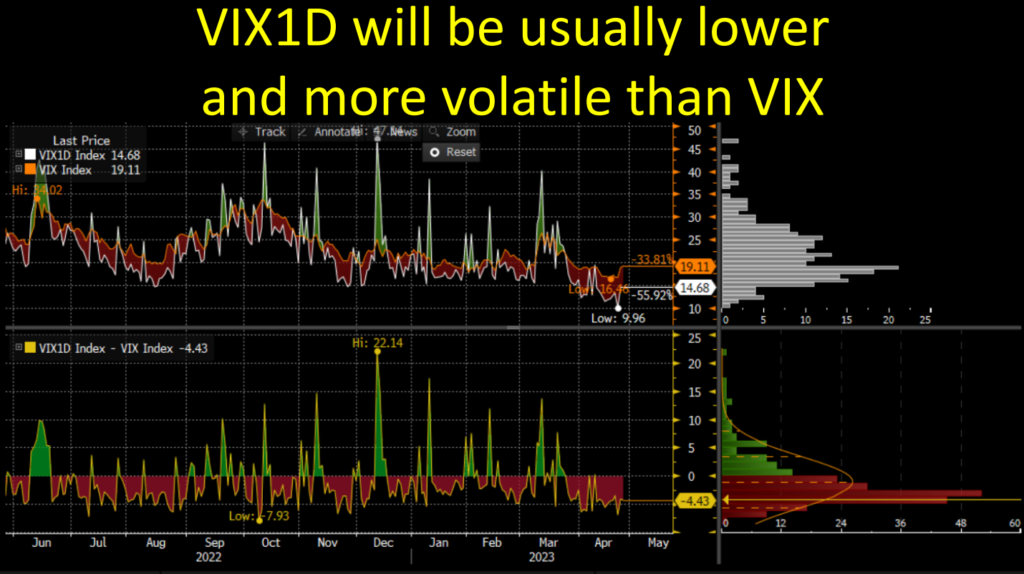

VIX1D will be more volatile than VIX

VIX1D captures the very short term volatility so it should be more volatile (vol of vol) than the VIX. You can expect it to shoot up close to Fed meetings and US macro numbers release. The past value of the VIX1D haven been backdated in Bloomberg and indeed the VIX1D spikes systematically some days before the FOMC meetings.

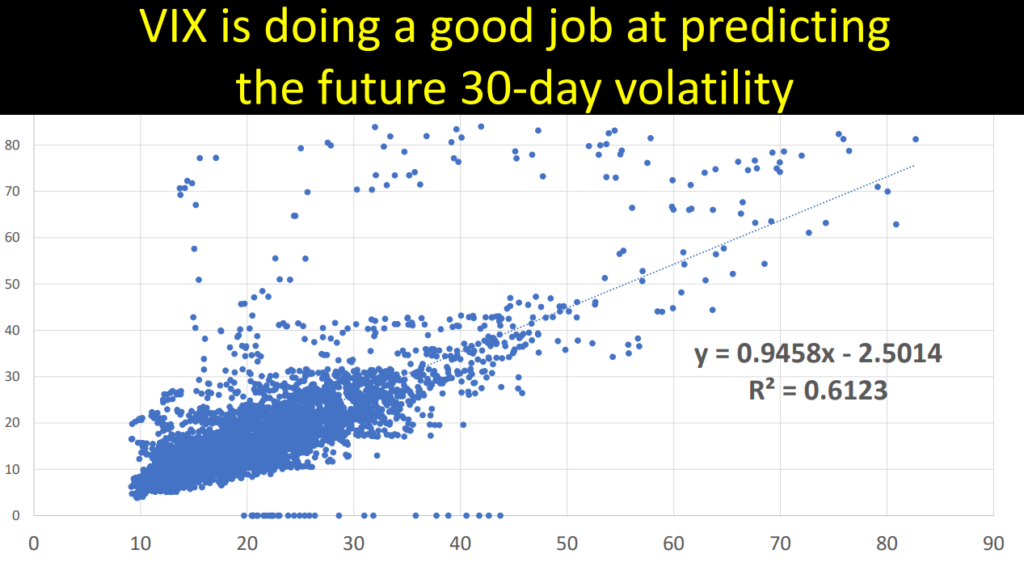

The usual VIX is a good estimator of future month volatility

As for the main VIX, weighting the options by 1/K2 is not a random choice but comes from the famous formula that shows that expected future variance can be replicated by a portfolio of options strike K with weights 1/K^2. As such the VIX should be a good indicator of the 30-day future variance, in theory. And it works quite well in practice, if you regress the 30-day future vol on VIX for the last 20 years, you will get an R-squared of around 60%. (As a sidenote, if you count on VIX to predict the direction of the market, you will do very badly, just check)

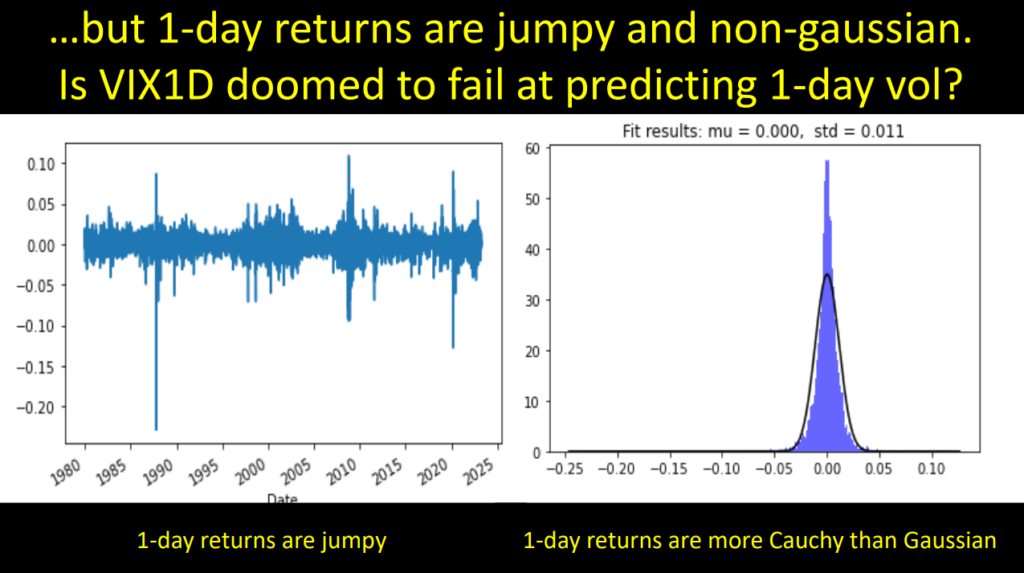

VIX1D will probably worse at predicting next day volatility

The theoretical assumption behind the predictive power of the portfolio “in 1/K^2” is that the price process does not jump. In practise, prices jump (see 2020, 2008, 1987, 1929 for extreme examples). Over a window of 30 days, the effect of jumps can be diluted by the other 29 days, but over a window of 1 day, the theoretical asumption does not reasonable. Just look at how fat tailed are daily returns… The 1-day returns look like a Cauchy rather than a Gaussian, because of those jumps. SO most likely VIX1D will be a worse predictor for the 1-day future volatility than the VIX for the 30-day volatility.

So will the VIX1D be totally useless? Despite its poor predictive power – I believe – it still gives a good idea of the next day sentiment, and for that reason no doubt it will very soon enter the Ratio Zoo! Expect fortune tellers to use VIX1D over VIX to predict tsunamis,