… a reminder that potential risks can become a reality.

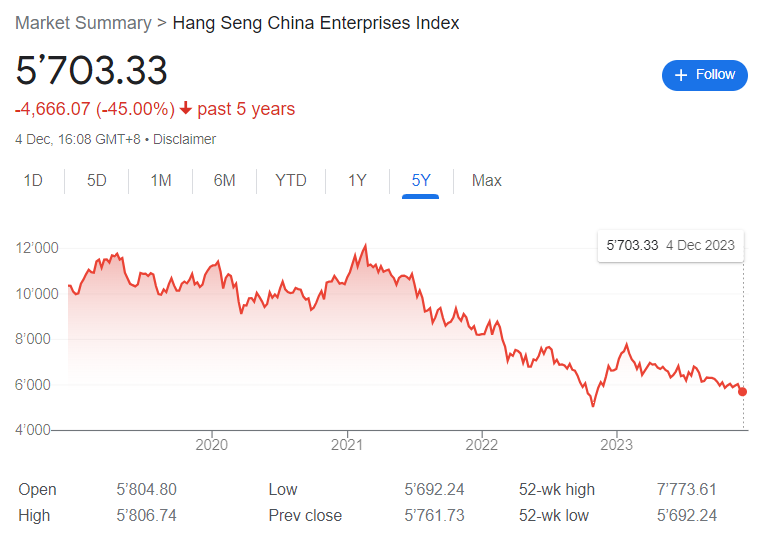

According to The Korea Times, South Korea’s Financial Supervisory Service is getting worried that autocallables were mis-sold to retail investors as they are facing potential $billions in losses, due to the poor performance of the HSCEI Index. They are now investigating banks and brokerages involved in the distribution of those products. As a reminder, the South-Korean structured product market is one of the largest in the world, and is very heavily exposed to HSCEI. HSCEI is down -45% over the last 5 years.

Does it mean the FSS have waited for the negative scenario to materialize before investigating if the products were mis-sold ?

It looks like it.

Given the performance of the HSCEI, investors are likely to lose 40-50% of their initial investment. When you sell a down-and-in put in order to get extra yield, you indeed take the risk that the put ends up in the money…

But that’s alright, most likely those products were part of a diversified portfolio: some assets lose, some assets gain.

Or were they not?

“Wise people learn when they can, fools learn when they must.”

Wellington