The Rising Tide of South Korea's Structured Products Market In the heart of Asia's financial...

Latest articles on Markets

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also...

HSCEI TV : How Structured Products Distort Volatilities

In the world of structured products, and as mentionned in a previous post, 2024 will be an...

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for structured products. A favourite product is the...

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a reality. According to The Korea Times, South...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a competence? or a promise for future...

Roche…. getting closer to the cliff edge

The Q3 results of Roche disappointed the market. At 11:00am the spot is down 4.70%... The stock is...

What To Expect From VIX1D, The New One-Day VIX?

This week, another VIX was launched by CBOE: the VIX1D. it is meant to measure the 1-day...

MOVE vs VIX Ratio: Is That A Relevant Metrics ?

The Move/VIX Ratio is now very fashionable Recently, graphs comparing the MOVE Index to the VIX...

Credit Suisse takeover? Silicon Valley Bank Bankruptcy?.. Been There, Done That.

The 2023 financial saga with Silicon Valley Bank and Credit Suisse reminds some of us of the 2008...

Products

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of...

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a reality. According to The Korea Times, South Korea's Financial...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a competence? or a promise for future underperformance ? Regarding...

Derivates

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica...

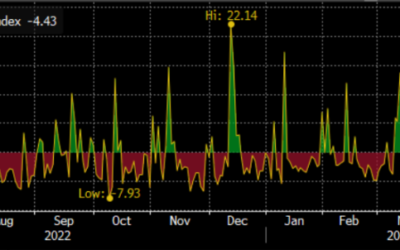

HSCEI TV : How Structured Products Distort Volatilities

In the world of structured products, and as mentionned in a previous post, 2024 will be an extraordinary year in South...

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of...