The 2023 financial saga with Silicon Valley Bank and Credit Suisse reminds some of us of the 2008 financial saga with Bear Stearns and Lehman (Although Lehman was let go..). If it feels like we have not learnt much in 15 years… look at what happened in 17th century Sweden, and it will look like we have not learnt much in 350 years!

Sweden’s coins at the time were large and heavy plates of copper. A businessman called Johan Palmstruch, who was born in Latvia but traveled through the Netherlands and Sweden, smelt that something could be done to modernise that archaic financial system. And to make some good money.

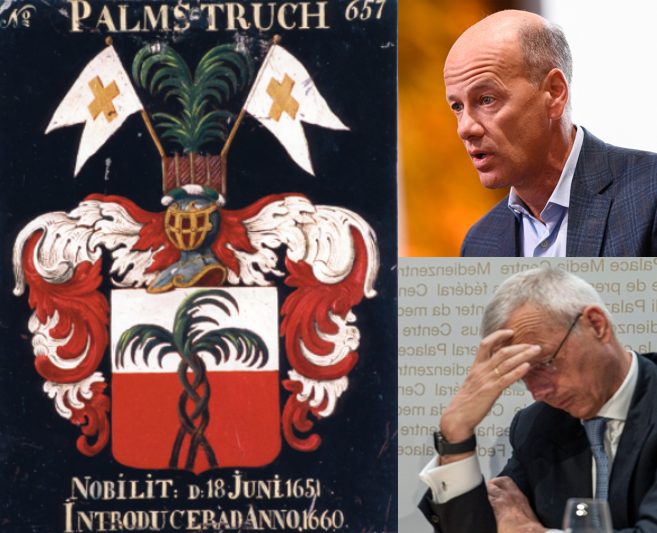

After several attemps, he finally convinced king Carl Gustav to let him open the bank Stockholms Banco in 1656. The promise was that profits would be shared with King. Palmstruch started by accepting the large copper coins as deposits. He would store them in a vault and issue a paper note as a receipt backed on the copper. Swedish merchants and dealers loved it and copper money started pouring in Banco’s vaults. Seeing those piles of copper, Palmstruch naturally decided to give loans. Commerce expanded in all Sweden. Palmstruch was ennobled and given his coat of arms (see below).

Some perturbation entered the system (call it rate rise or inflation)… the King died and a new decision was made to put less copper in the new coins for the same face value. Consequently, the old coins increased in value.. so Banco’s depositors knocked at the door and claimed their old copper plates. But there was not enough copper in the vault as it was used for loans (see SVB). Banco was unsuccessful in calling back the loans, so Palmstruch decided to print new paper notes to calm the depositors that were usable to pay taxes. The innovation here is that the paper notes were printed without any new copper as collateral (see Fed). It worked for a while until the confidence vanished and a proper bank run started. Banco could not give the coins back to depositors.

Banco’s situation posed systematic risks, it was too big to fail! The Swedish Crown bailed the bank out and created what is now the Swedish Central Bank Sveriges Riksbank.

Palmstruch was stripped of his nobility title and got prosecuted for fraud. He was sentenced to death, until the sentence got changed into emprisonment and ban from any business activity.

Those who see in Palmstruch’s arms the Silicon Valley palm trees or the the Swiss Cross probably have too much imagination, don’t they ?