South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of HSCEI and other other indices (S&P500, STOXX50E, Kospi etc..). The total live size of that best seller is around $20billion and $15billion of that are apparently going to expire in 2024, with the biggest month is May 2024 with $2billion expiring.

The chinese equities index HSCEI has performed so badly (-48% over 5 years) that retail investors are expected to face massive losses on those autocalls, to the extent that the Korean regulator is investigating if those products have been missold.

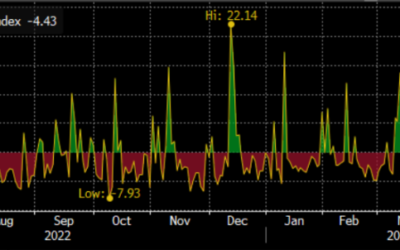

Step-down autocallables on HSCEI bring important barrier risks at maturity

The usual structure there is the “step down” autocallable where the autocall triggers goes down at each observation, the last one being observed on expiry day and being usually at 50%-60% of the initial level. It allows for the structure to autocall even in bear markets, but HSCEI performed so badly that it missed all triggers… The strike of the short put is not necessarly 100%, it can be lower, at 75% for instance. Taking 15billion expiries over 2024, 50% barrier and 75% strike, it is a $5billion digital spread over the year around the current levels (that are around 50% of 2020-2021 levels).

What to expect?

The unwind of the net delta hedges should put pressure down on the index. Gamma should be substantial and will flip around barrier levels. Pin risks will be abundant!

Roche was under the spotlights in 2023, HSCEI seems to be seeking attention in 2024!