The Rising Tide of South Korea’s Structured Products Market

In the heart of Asia’s financial innovation, South Korea stands out as a colossal market for structured products. Among these, autocallables based on indices like HSCEI, S&P 500, STOXX50E, and Kospi have garnered immense popularity. As we step into 2024, a pivotal year, approximately $20 billion worth of these autocallables are active, with a staggering $15 billion set to expire. May 2024 marks a critical month, witnessing $2 billion of these expirations.

HSCEI’s Performance: A Concern for Retail Investors

The HSCEI’s underwhelming performance, plummeting by 48% over the past five years, casts a shadow over retail investors, potentially leading to significant losses on their autocall investments. This alarming trend has triggered investigations by Korean regulators into the possible mis-selling of these products.

Understanding the Mechanics: Step-Down Autocallables

Central to this discussion is the “step-down” autocallable structure. This design allows the autocall trigger to decrease at each observation, with the final one on the expiry day typically set between 50%-60% of the initial level. Although this structure aims to benefit even in bear markets, the HSCEI’s drastic fall has led to a failure in meeting any triggers. With the strike of the short put potentially lower than 100%, at 75% for example, and considering $15 billion expiring in 2024, we’re looking at a $5 billion digital spread across the year, especially poignant at current levels mirroring only half of those seen in 2020-2021.

Market Dynamics: What Lies Ahead?

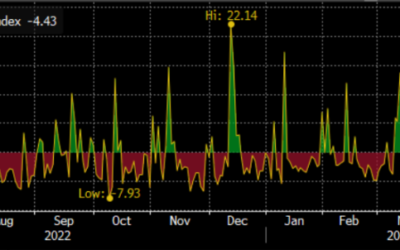

The unwinding of net delta hedges associated with these autocallables is poised to exert downward pressure on the index. Expect substantial gamma activity flipping around barrier levels, accompanied by abundant pin risks. Following the spotlight on Roche in 2023, HSCEI is poised to capture significant attention in 2024.

Navigating Through 2024: A Critical Year for Investors

As investors and market watchers, we stand on the brink of a crucial juncture in 2024 for South Korea’s structured products market. The unfolding scenario around HSCEI autocallables not only underscores the inherent risks and complexities of these financial instruments but also highlights the need for rigorous oversight and investor education. As we navigate through these turbulent waters, staying informed and vigilant will be key to understanding and mitigating potential impacts on investment portfolios.