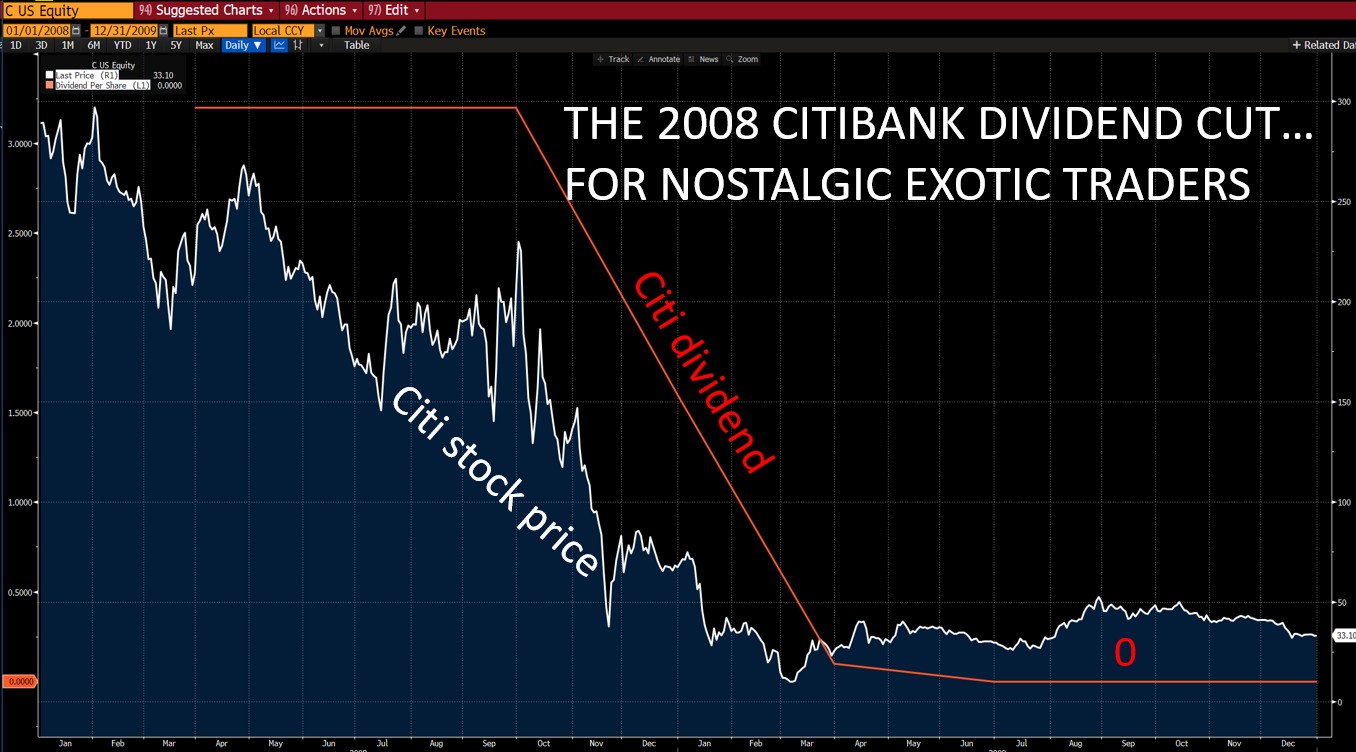

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica doing the same in 2012.

In 2024 it is Bayer’s turn to scrap its dividend. Nothing new here.

Citibank was a popular stock for worst of autocallables in 2006-2007. Telefonica was in every basket pushed by the big retail distributor Banco Santer or BBVA. The pharma theme is also popular (a defensive sector, right?) and so was Bayer.

Those three stocks had a horrible price action before and became the “worst” of any combination of 3 you can imagine. The worst then concentrate all risks: volatility risk, dividend risk…

As those three stocks became the worst of many combinations, dividend risk ballooned. Any worst time then for those stocks to scrap there dividends?

No

Citi 2008 costed millions to exotic trading desks, Telefonica 2012 was an absolute disaster. Hopefully Bayer 2024 will be less harmful as traders learn from the past.

At least I was told.