The debt ceiling of the USA is not yet the focus of the markets. Nevertheless on 13 January, the secretary of the US treasury Janet Yellen has issued a warning letter to the speaker of the house of the representatives and to the Democratic and Republican leader.

She wrote that “ beginning of Thursday, January 19, 2023, the outstanding debt of the USA is projected to reach the statutory limit. Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations”.

“The use of extraordinary measures enables the government to meet its obligations for only a limited amount of time. It is therefore critical that Congress act in a timely manner to increase or suspend the debt limit. Failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability. Indeed, in the past, even threats that the US government might fail to meet its obligations have caused real harms, including the only credit rating downgrade in the history of our nation in 2011.”

“I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

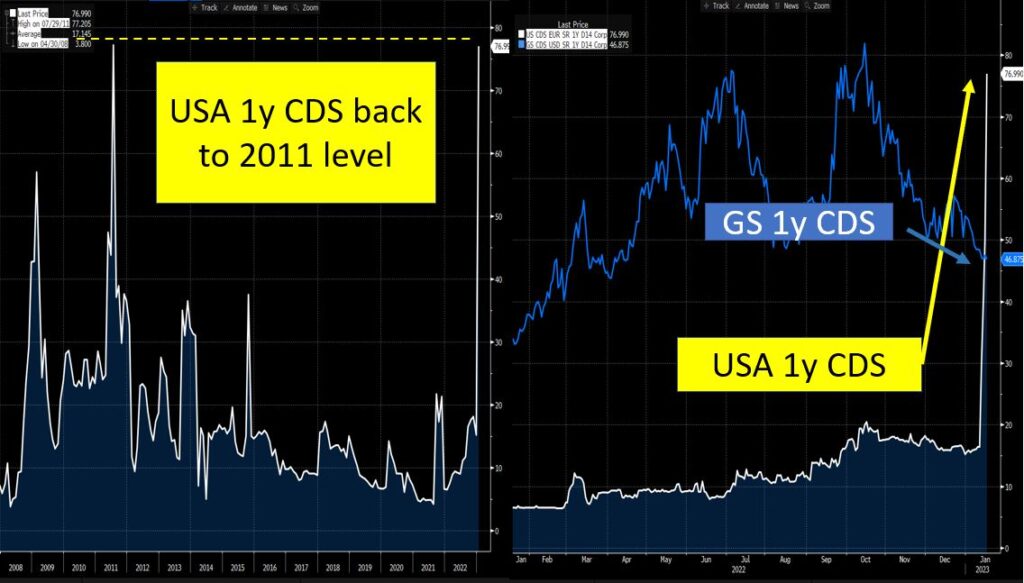

In the last two days, the 1-year CDS on the USA has jumped from 15bps to 77bp, back to the 2011 levels at the time of the downgrade, implying a probability of technical default 5 times higher. At a time where corporate credit spreads are tightening, we end up to the a situation where , in order to protect themselves versus a technical default, credit traders are willing to pay more for protection on the USA than for protection on a financial like Goldman Sachs !