The Central Bank of Ireland reiterates its warning on decrement indices

In a letter sent to finance professionals in March 2023, the Central Bank of Ireland reiterated their recommendation with regards to decrement indices. They recommend to write in the marketing material :

“The value of this product is impacted by a Decrement Index with a fixed [x] % / [fixed point value] dividend withdrawn each year. A Decrement Index is a complex product feature that may have a negative effect on the return of your investment at maturity.”

“Decrement indices typically use a fixed dividend technique. When the fixed dividend deduction of [%] / [fixed point value] is higher than the actual dividends paid, this acts as a ‘downward drag’ on performance. This means that an amount is deducted from the value of the underlying index regardless of how the index has performed on an ongoing basis. Clients need to be cognisant of this, given that the final value of this index will determine the level of capital protection and investment return you will receive.”

The rise of decrement indices since 2020

Decrement indices have been in the market for some years but their market share has never been so high. Since the dividend rout of 2020, their use has doubled. By setting a synthetic dividend (decrement) higher than the implied dividend yield, those indices both offer better terms (coupons) than the original index and remove the dividend risk from the banks’ books. They correspond partially to the dream of the exotic trader: 𝗻𝗼 𝗿𝗶𝘀𝗸 (for them)!

Are Decrement Indices necessarily bad ?

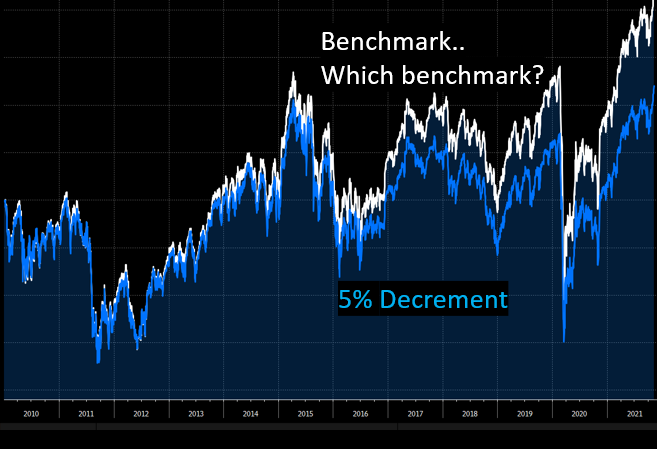

𝗔𝗿𝗲 𝘁𝗵𝗲𝘆 𝗯𝗮𝗱? Certainly not as long as the investor is retributed by the additional risk he takes. Because.. risks do not disappear like steam in the air.. if the banks do not take the dividend risk, it means that the investor keeps it in some way. Or rather, that his performance versus the benchmark will highly depend on the real dividend. Imagine investing in a Eurostoxx 4% decrement, if the Eurostoxx dividend yield is effectively 2.50% for the next five years, your underperformance will be 5*(4%-2.50%)= 7.50% . 7.50% is not little especially when the final payoff is digital like in most structured products. If the realised dividend yield is higher, you overperform, but good luck until Eurostoxx pays more than 4%..

Naturally as an investor, you want to be retributed for that extra risk. Assessing the extra risk means you can relate to a benchmark, unfortunately it is often impossible to determine clearly what the benchmark is as the title of the index often hides the benchmark and rather includes “feel good” marketing terms (for instance: ESG, blue, green, champions, sea, sky, water, opportunity, growth, etc.). That is the big issue.

The trend over the years in Structured products has been from complex payoffs on plain underlyings to plain payoffs on complex underlyings. Not sure what is better!

You can read more on decrement indices here :