Thematic investing has been one of the greatest successes of the past years. It consists in picking a theme that is doomed to be disruptive and shape the future, and to then select a basket of companies that would benefit from the rise of that theme. Such themes can be cybersecurity, metaverse, work from home, genomics, vegan eating etc.

Those baskets of stocks are packaged into trackers issued by banks or into ETFs, and can bear hefty fees.

It is definitely a good business for the providers. In times where “every goes up”, and when investors could be tempted to simply purchase a very low fee S&P 500 ETF, one certainly needs some imagination to come up with a product that an show an attractive performance and carry attractive fees for the banks. Finance is not a philanthropic activity, so there is no harm in that, but are those thematic trackers/ETFs a source of returns for the investors?

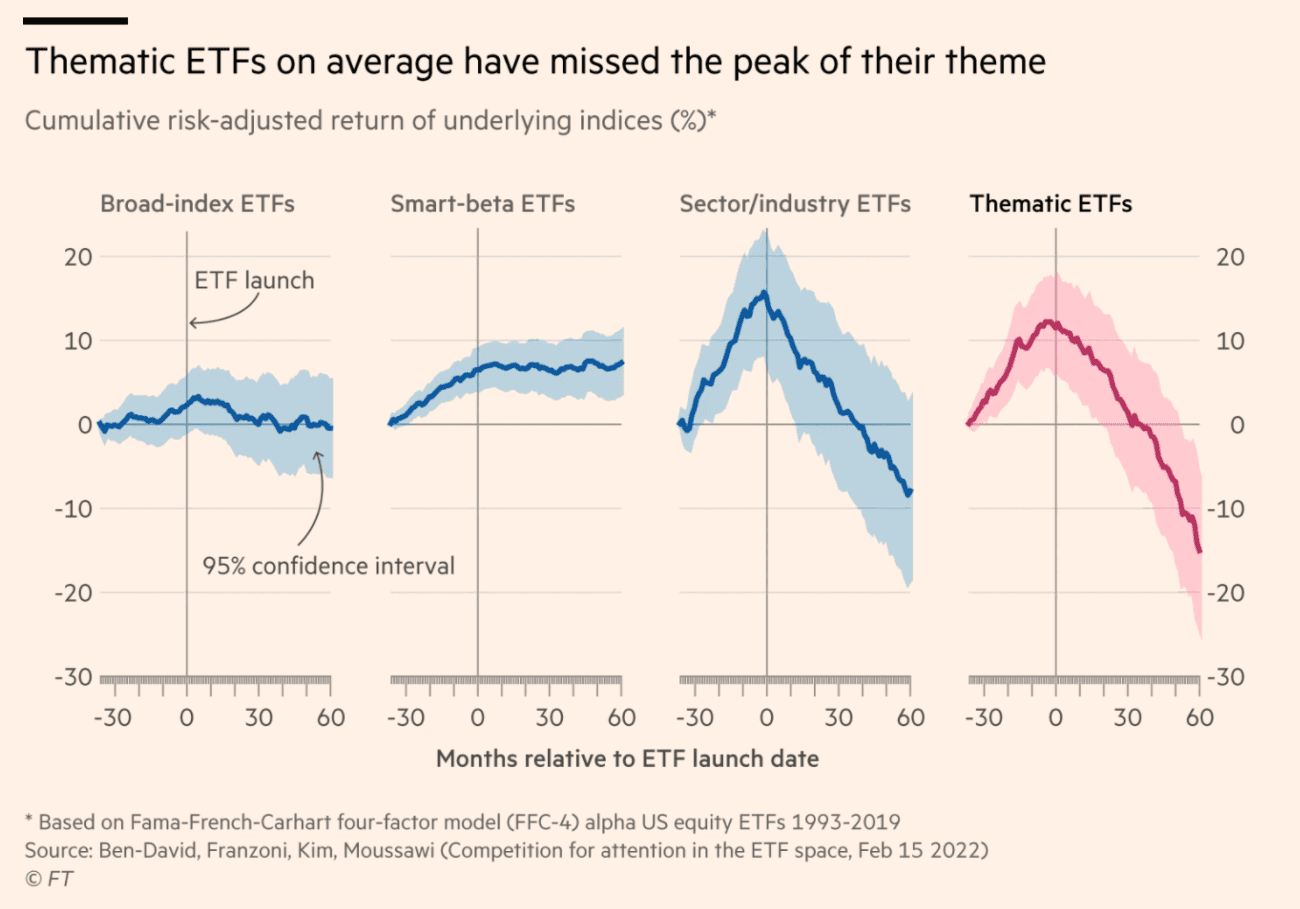

Unfortunately a recent article by Emma Bode published in the Financial Times seems to say that such ETFs tend to sink just after they are launched. The article is based on a research paper published by four academics “Competition in the ETF space” available here.

“According to the academics — Itzhak Ben-David, Rabih Moussawi, Francesco Franzoni and Byungwook Kim — the very worst time to buy thematic ETFs, which hold shares that follow a popular investment trend or theme, is when they launch. Highlight text That is principally because the funds tend to launch just after the peak of their theme, and immediately before a steep fall in returns. The research focused on US equity ETFs, traded on the US stock market, between 1993 and 2019. It found that not only did thematic ETFs struggle, but sector-focused ETFs performed almost as badly and accounted for a larger segment of the ETF market. Together, the two categories accounted for nearly 20 per cent of assets under management and generated 36 per cent of the fees.”

The graph gives a clear picture of that phenomenon:

It is really surprising to see that the launch date seems to correspond exactly to the top ! That coincidence is striking even though the overall reason for that behaviour is not so difficult to understand. Themes are launched when they meet at least two criteria : they are fashionable and they exhibit strong past performance. We all know that past performance is not a good indicator of future performance, but we also all know a bad past performance is a very good indicator of a future marketing failure. So themes tend to be consisting of stocks that exhibit exceptional past performances, most likely overvalued and that will go back to their value sooner or later when the theme gets out of fashion.

The behaviour of the so-called Smart-Beta ETFs is a bit different. They are very often market neutral and try to extract performance from a very specific factor. It is always possible to find a strategy that worked well in the past: when one looks, one finds ! It does not mean that it will not continue, but the performance needs to pass through robustness tests, be statistically significant and have some intuitive explanation behind it. What the graph shows us is that very often, smart-beta strategy providers do not resist the temptation of launching strategies that are not robust enough, and hence have no good reason to keep performing. The investor will then buy a strategy that would have worked well in the past, but that stops working once live.