Last week, Barclays announced that it has stopped the sales and new issuance of its Exchange Traded Noted VXX (VIX short term futures ETN). It is always bad news when a tradable asset is not available anymore: the more assets available, the more opportunities for diversification and risk management. Nevertheless, this time, it is worth noting that VXX UP has been often used as the underlying of autocallable payouts, and those were probably painful memories for those who decided to invest in such products. VXX is presented as a hedge against nervous markets, and so are autocallables on VXX.

So what is VXX ?

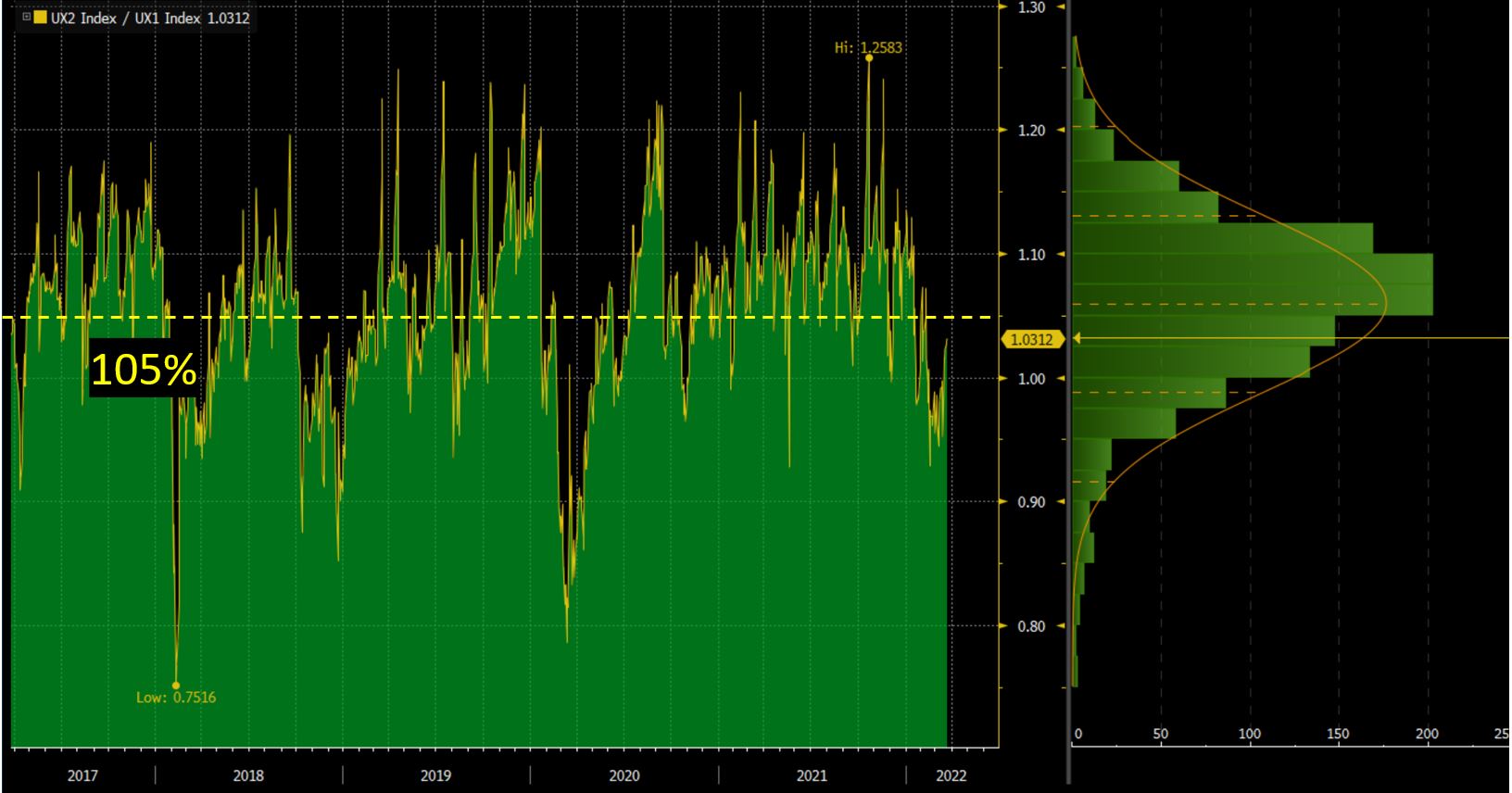

As its name indicates, VXX is a fund that invests in short term VIX futures. It will buy the front month active futures and as those are coming close to maturity will roll them into the next month future. As the reader knows the term structure of the VIX futures is usually upward sloping. It is easy to estimate that slope :

Below is the graph of the ratio 2nd active contract / active contract, plotted for the last 5 years. One can see that historically the 2nd contract (now May) trades 5% above the front contract (now April) (ratio is 1.05 on average)

Rolling costs

If the 2nd contract is on average 5% higher than the active contract, it means that each roll will cost investors 5%. So compounded 12 times, it will cost 45% per annum.

If nothing happens (if the volatility does not move) such a strategy will be down 45% per annum just because of those rolling costs. VIX will be unchanged but you will be down 45% !

That can be easily verified by plotting the ratio VXX / VIX (see graph below)

If an investor buys the VXX ETN, he can make money if the VIX spikes shortly after the purchase and if he sells then, as keeping it longer will cost him on average 5% per month. The behaviour of the asset is very similar to an insurance contract in that sense.

The big difference, if the investor chooses VXX as the underlying of his autocallable, is that he may be stuck until maturity with a very poorly performing asset. If he is lucky and the volatility spikes (a spike in vol means the vol has a return of +25% or +50%) around the autocallable date, he may get a coupon that will most likely be a lot lower than the VXX performance.

Volatility of VXX

What makes the VXX very attractive for structured products is its volatility. VXX is homogeneous to a 1-month volatility number. So the volatility of VXX corresponds to the volatility of the 1-month SPX volatility

The 1-month volatility of SPX can typically change by 1-2 points every day. With current 1-month volatility being around 15-20%, that corresponds of a daily return of +/- 8%-10% per day, which corresponds to a volatility of around 100%

VXX will have an implied volatility around 100, so when used as an underlying of an autocall product, it will offer high coupons even with low strike and barriers.

An investor using VXX as the underlying on an autocallable will face two scenarios :

if he is right an the vol spikes quickly, he will get a coupon that will be a fraction of the announced per annum coupon

if he is wrong (being wrong means volatility does not move), he will be stuck with a very poorly performing product that may affect his capital.