Investors do no like to lose money when the market is correcting. Nevertheless, they do not like to spend money to buy puts either. They usually go for cheaper versions of the vanilla put: put spreads, knock out puts…best of puts.

Best of puts are popular because they are not very expensive, and still they are supposed to perform in a bear market because “when things go down, everything goes down” (including the best). Looking at numbers, they do not seem to hold premise.

What is a best of put ?

A best of put on SMI, SX5E and SPX is a put option where the underlyer is the best performer at maturity amongst SMI , SX5E, SPX.

Let’s imagine a 6-month at-the-money put on the best of SMI, SX5E and SPX.

if the 6-month performances are

| Index | Performance |

| SMI | -7.25% |

| SX5E | -8.00% |

| SPX | -6.50% |

then the best performer is SPX (-6.50%) and the best of put will pay 6.50% at maturity.

A 6-month 95%-strike best of put would pay 1.50% at maturity.

Why is a best of put cheaper ?

By definition of its payoff, the best of put has to be cheaper than any of the vanilla puts (because it always pays less!). In our example above, the price of a 6-month 95%-strike best of put will be less than the price of the same put on SMI, or on SPX or on SX5E.

How cheaper it is depends on the implied correlation amongst those three indices: the lower the correlation, the higher the performance dispersion at maturity, so the lower the price of the best of put. But in practice, the implied correlation between indices is high and the cheapening is not that high.

Here are some indicative prices to get a clearer idea (prices are as of beginning of April 2022). Those are the prices of the puts respectively on SPX, SMI, SX5E, on the equally weighted basket and on the best of :

| Underlying | Price of the 6-month 95% put |

| SPX | 4.15% |

| SMI | 3.32% |

| SX5E | 5.77% |

| Basket | 4.20% |

| Best of | 2.65% |

An investor who would hold Swiss equities, American equities and European equities in equal parts would naturally be inclined to buy a put on the basket 1/3 SMI 1/3 SPX 1/3 SX5E. That would cost her/him 4.20%. He could go for the best of put and pay only 2.65% (so a saving of 1.55% upfront).

Is it worth it ?

The pitch for buying a best of put instead of a basket put is that you save money and “when things go down, they all go down”. But is that really true ?

To check that, we take data from January 1, 2000 until April 1, 2022. We look at 6-month performance of the best of (SPX, SMI, SX5E) on y-axis versus the performance of the basket on x-axis. We have 5674 returns to get insight from. We get the following :

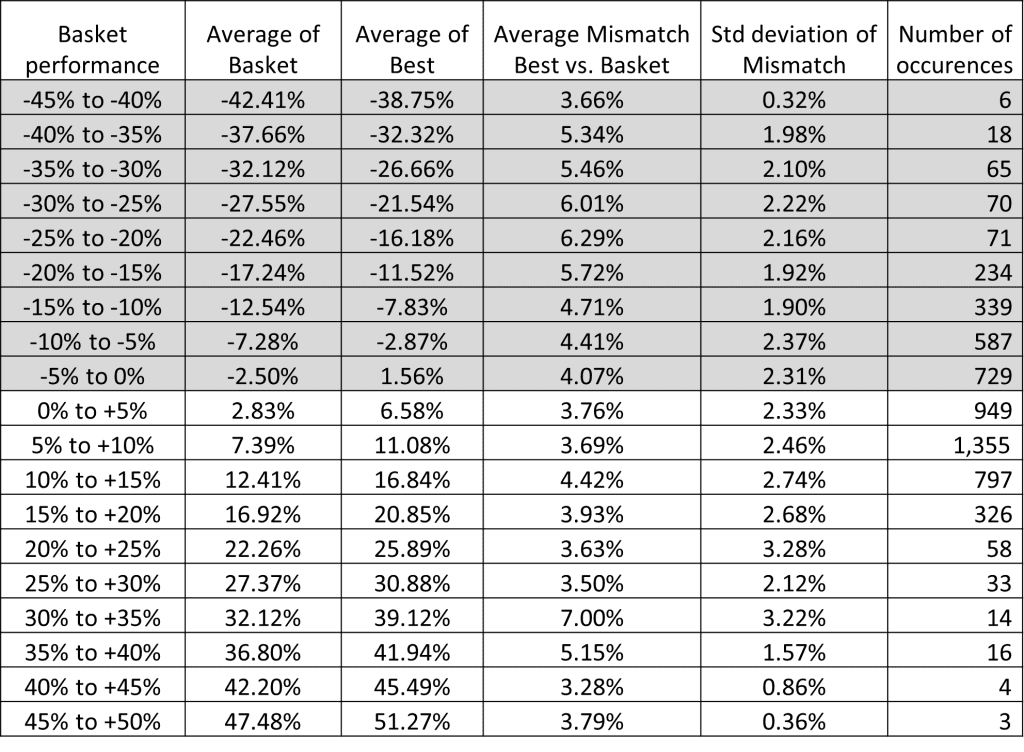

The left bottom corner are the events where the basket is down. One can see that on the downside, there is still a lot of dispersion. When looking at details, on average, the best of is quite far from the basket, even when “things go down”. Here we display the average difference between the best of and the basket, depending on how “things go down”.

Those stats are crual… when the basket is down between -20% and -25% for instance, the best of outperforms the basket by 6.29% on average. So your best of put will pay 6.29% less than your basket put.

So upfront you will have saved 1.55% upfront, but if “things go down”, your hedge will underperform by 6.29%.

Is that worth the initial saving ?