When investing into a Barrier Reverse Convertible or Autocallables, there are two schools for the choice of the barrier: The European (or Final) barrier school and the American (or continuous) barrier school.

Going for a European barrier means going for a barrier that will be closer to the current spot level, but whose status will only be observed at maturity. Pricing wise, for a 24-month BRC, its level only depends on the shape of the 24-month implied volatility. Precisely, it only depends on the volatility level at the barrier and on the local skew at the barrier. Any other volatility point is irrelevant.

Going for an American barrier means going for barrier that will be further away from the current spot level, but whose status will be observed at any time until maturity. The level of the barrier will depend on the implied volatility for all maturities until 24-month. Compared to a European barrier, the American barrier is very sensitive to short term level of volatility and skew.

How to rationally choose between a higher but safer European barrier and a lower but riskier American barrier?

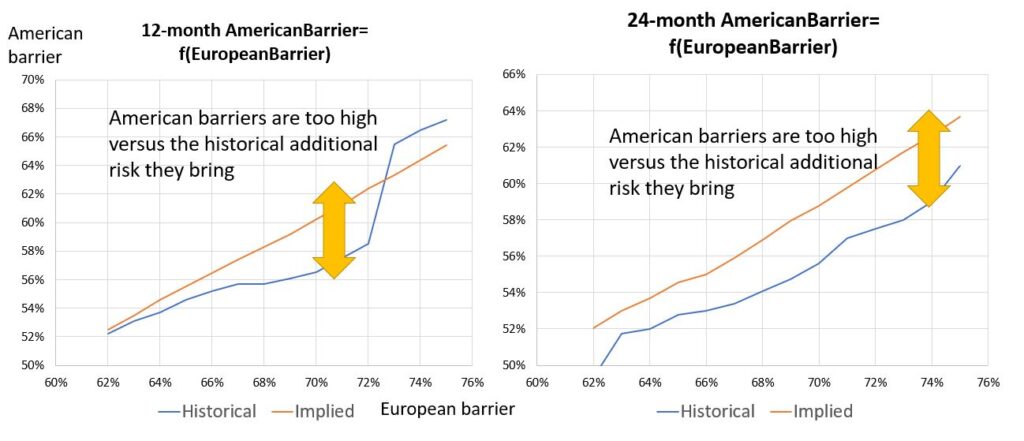

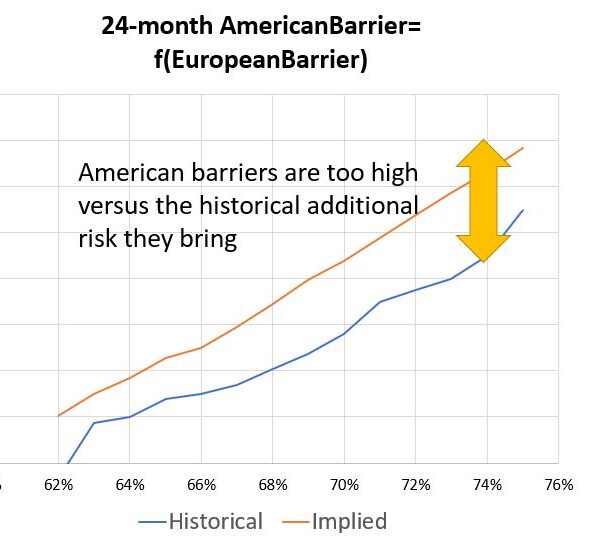

The choice will be dictated by the level of the short term vol and skew. Let’s take a look at the S&P500, it currently has a rather low short term volatility and skew so most likely the American barrier will not look good versus the European barrier. That’s indeed what the numbers are telling us. We look at stats since 2000 and look for each level of European barrier, what is the level of American barrier that gives the same historical payout. We do that for 12-month and 24-month intervals. Clearly for 24 months, the American barrier (priced by the market) is too high versus the European barrier (by 3% to 4% at all barrier level).

For 12 months, this is also the case unless you go for American barriers in the 50% area.