Investors are always reluctant to buy puts to protect their portfolio. Indeed, the market “usually goes up” and spending premium to buy protection is seen as a waste of money and a source of performance impairment. Worth noting that they usually buy and hold the hedge until maturity.

They go for cheap hedges. Considering vanilla solutions, for 3-month maturity, the 95% strike is very often a favourite. A 95% put is cheaper than the ATM put (by around 1.70%) but at the same time 95% does not seem too far out : in other words if the market goes down it will go there, so it looks like an efficient hedge.

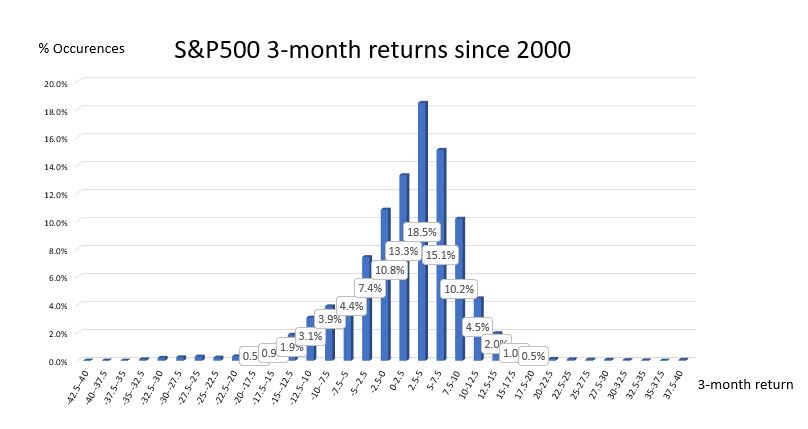

In practice the scenarios where the SPX is down between -5% and 0% make up for 18% of the occurrences, it’s a lot. Scenarios where SPX is down more than -5% make only 16.20% of occurrences, and to breakeven you need a move down of around -8%.

The wise investor (in terms of timing) who bought a 95% Put on SPX 3month ago would have paid more than 3.00% for it and got only 3.50% back… a very poor reward for a very good view.

There are much better ways of cheapening hedges and history shows that lowering the strike is not the right way. We will see better solutions!