Investors have piled up on equity autocallables in the past years to collect some yield in a zero-interest-rate world. Such structured products are usually affected to the alternatives pocket of investment managers. Much to the frustration of structured products distributors, they are not classified as equities or fixed income. Some investors monitor the implied equity exposure by computing the delta and would say that an autocallable with 30% delta is equivalent to a 30% allocation in equity. Does it then mean than the autocallable is then a 30/70 portfolio ?

No

In terms of risk, an autocallable is indeed fixed income and equity, but not in the sense that the risks sum up to 100%. Take a 3-year autocallable, callable annually, on S&P500, with 6% guaranteed coupon and 60% European barrier.

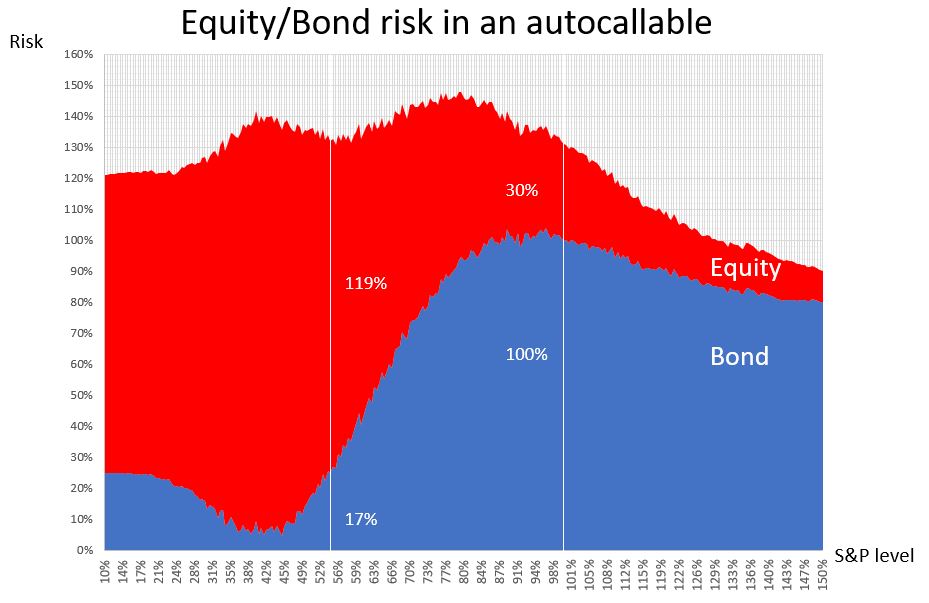

Initial delta is 30% and initial duration is around 1.3. So the initial allocation is ”30/100”: 30% equity AND 100% in a 1.3y bond.

If the S&P500 goes up, the delta goes down, and so does the duration. If the S&P500 is up +50%, the autocall will autocal for sure, so the bond is now 1year only (so in duration terms 80% of the previous one), and equity delta 5% only. We have a 5/80 portfolio.

If S&P500 sinks, say to 50%, the autocall goes to 3y expected duration. Which would mean that the bond part increases. But the equity delta increases also to 119%, and more than offsets the increase in interest rate risk (via the forward). The only bond part of the product comes from the guaranteed coupons. So now the autocall is equivalent to a “119/17”. Not that if the coupon were conditional, the autocall would be equivalent to negative bond!

The equity autocallable is really an hybrid instrument (without even mentioning the credit risk of the issuer), and probably deserves its allocation into alternative. But in a year where bonds move like equities, does it really matter?