Empress Josephine, Napoleon’s wife, was fond of exotic animals. She would have monkeys, kangaroos and zebras in her gardens at her countryside house “Malmaison”, all imported directly from Australia. One species she was particularly proud of was the black swan. She is said to be the first person in Europe to own such rare animals, and in the ponds of Malmaison you would see as many black swans as white swans.

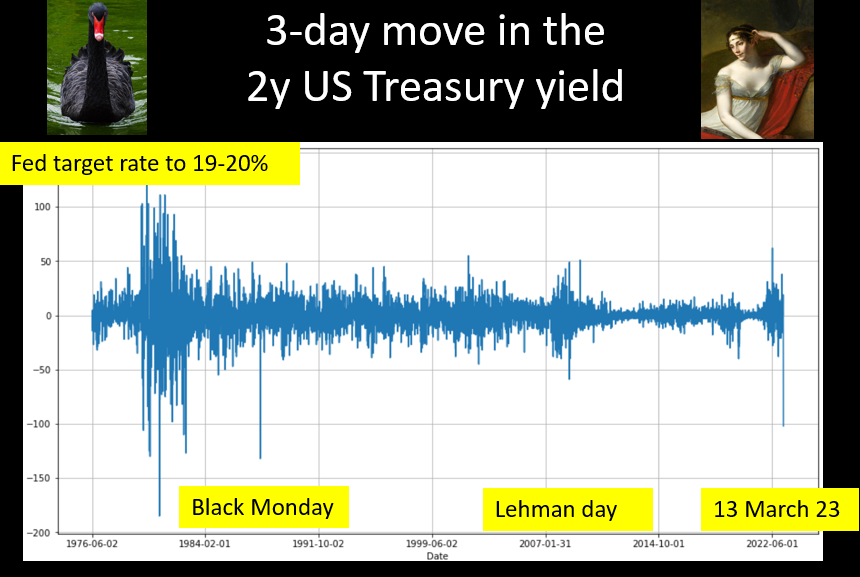

Outside Malmaison, and since Taleb’s best seller, a black swan designates a very rare event, the kind of event that models based on normality cannot incorporate. We probably observed such a black swan on Monday. Indeed this week, we saw extreme moves in the bond space. The 2y yield on US treasuries lost 57bps on March 13th, that followed a drop of 45bps over the previous two sessions. The one-day move was dubbed as a “10 sigma” event by some commentators. Indeed that move is more than 10 standard deviations away when looking at the recent years. What does 10 sigma mean ? well assuming normality.. there aren’t enough seconds since the beginning of the Universe to observe a 10-sigma event with a probability more than 1/1million !

Looking at the 3-day move, we observed -102bps. That is way more than on Lehman day and comparable to 1987’s Black Monday. Such a move that is much more similar to what one could observe in the early 1980s when the Fed was fighting a 14% inflation (familiar?)

In Josephine’s gardens, black swans are common and are not considered as 10-sigmas. She would argue that the only reason why we think we saw a 10-sigma event is only because we had the wrong sigma!

That’s a bit concerning. As much as I like Josephine, I’d rather have her keep her swans for herself and spare the markets. The recent SVB failure, this very heavy move in the bond space which will for sure hurt some traders, the Credit Suisse situation, the 0DTE potential damages… this market is starting to look like a black swan pond.

Not tonight, Josephine!