Financial derivatives, Exotic options and Structured products

Last articles

US Presidential Election, VIX and OPTION MARKET

On Monday, October 7, the 𝗩𝗜𝗫 𝗷𝘂𝗺𝗽𝗲𝗱 𝗯𝘆 𝟯 𝗽𝗼𝗶𝗻𝘁𝘀, seemingly without cause. However, the reason is purely 'technical': VIX is short-sighted, only factoring in the next 30 days. On October 7, for the...

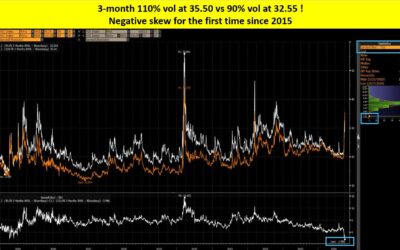

ATTENTION: NEGATIVE SKEW ON HANG SENG INDEX

The rush into Chinese equities has propelled the 𝗛𝗮𝗻𝗴 𝗦𝗲𝗻𝗴 𝗜𝗻𝗱𝗲𝘅 𝗯𝘆 +𝟯𝟱% over the last month! 𝗧𝗵𝗮𝘁 𝗿𝘂𝘀𝗵 𝗺𝗮𝗻𝗶𝗳𝗲𝘀𝘁𝘀 𝗶𝘁𝘀𝗲𝗹𝗳 𝗮𝗹𝘀𝗼 𝗶𝗻 𝘁𝗵𝗲 𝗱𝗲𝗿𝗶𝘃𝗮𝘁𝗶𝘃𝗲𝘀 𝗺𝗮𝗿𝗸𝗲𝘁 where investors are bidding up the upside...

The 2024 Outlook on Korean Autocallables and the HSCEI $5 Billion Digital: A Deep Dive

The Rising Tide of South Korea's Structured Products Market In the heart of Asia's financial innovation, South Korea stands out as a colossal market for structured products. Among these,...

Other Articles

BAYER SCRAPS ITS DIVIDEND… BEEN THERE, DONE THAT.

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica...

HSCEI TV : How Structured Products Distort Volatilities

In the world of structured products, and as mentionned in a previous post, 2024 will be an extraordinary year in South...

2024 Judgement year for Korean Autocalls and the $5billion HSCEI digital.

South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of...

South-Korean retail investors are losing money on Autocallables

... a reminder that potential risks can become a reality. According to The Korea Times, South Korea's Financial...

𝗜𝘀 “𝗝𝗼𝗵𝗻 𝗦𝗺𝗶𝘁𝗵, 𝗠𝗕𝗔, 𝗣𝗵𝗗, 𝗖𝗔𝗜𝗔, 𝗖𝗙𝗔, 𝗖𝗤𝗙, 𝗙𝗥𝗠” 𝗮𝗻 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗲𝗿?

Is accumulating post-nominal letters a sign of a competence? or a promise for future underperformance ? Regarding...

Roche…. getting closer to the cliff edge

The Q3 results of Roche disappointed the market. At 11:00am the spot is down 4.70%... The stock is now down 19% YTD...

Structured Products = Alternative Investments ?

Asset managers tend to classify structured products as “alternatives”. That is rather a classification by default than...

Is Optimising Structured Products Really Optimal ?

Banks and independent software companies offer optimisers / optimizers for structured products It is quite standard...

Structured Product Blues

Yield enhancement products have been the market favourite for years The most actively traded retail structured...

about me

Eric Barthe

Read More

Experience

years of experience in the field of derivatives and structured products.