by ericbarthe | Feb 28, 2024 | Markets

The Rising Tide of South Korea’s Structured Products Market In the heart of Asia’s financial innovation, South Korea stands out as a colossal market for structured products. Among these, autocallables based on indices like HSCEI, S&P 500, STOXX50E, and...

by ericbarthe | Feb 21, 2024 | Derivatives Theory and Practise, Markets

The veteran Exotic traders will remember Citibank scrapping its dividend in 2008. They will also remember Telefonica doing the same in 2012. In 2024 it is Bayer’s turn to scrap its dividend. Nothing new here.Citibank was a popular stock for worst of autocallables in...

by ericbarthe | Jan 25, 2024 | Derivatives Theory and Practise, Markets

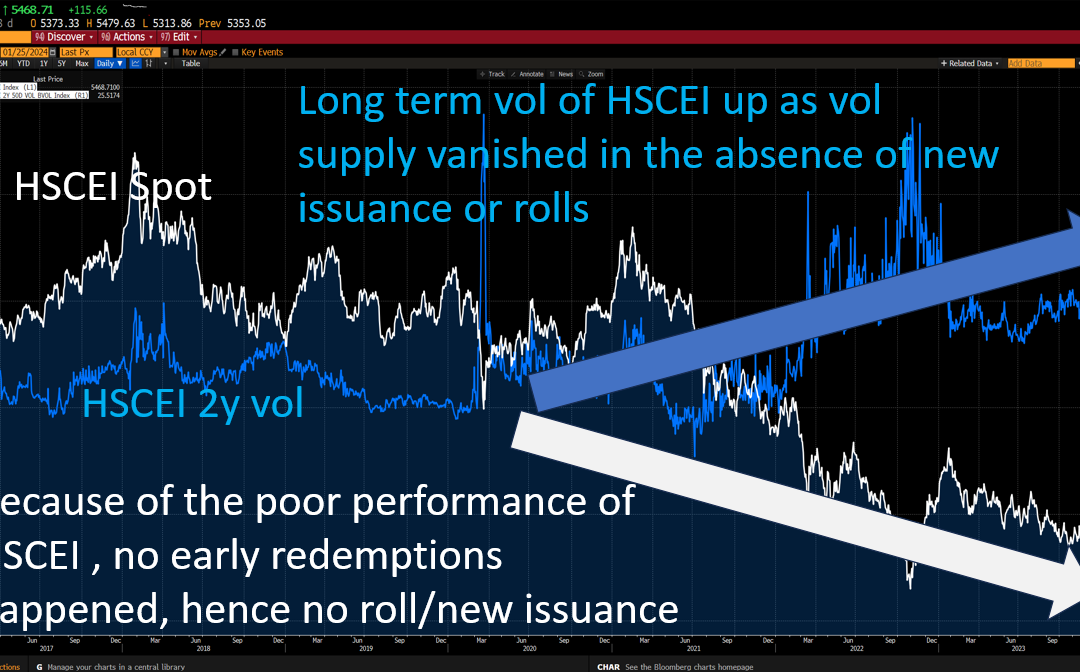

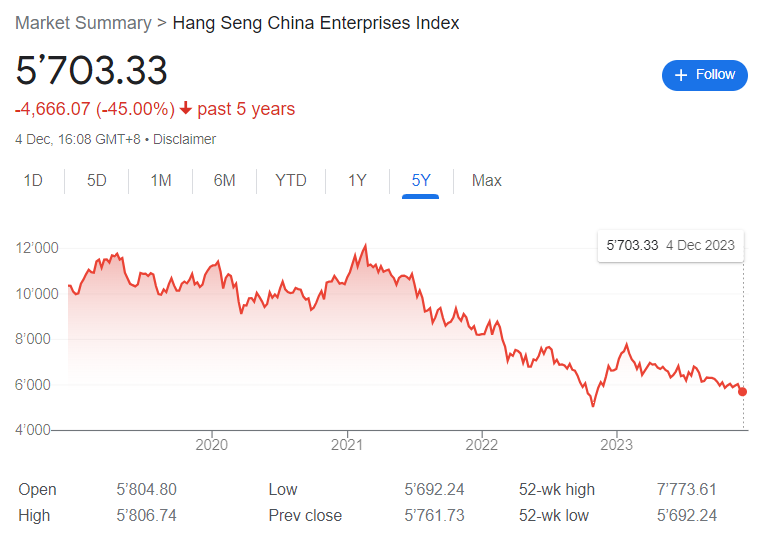

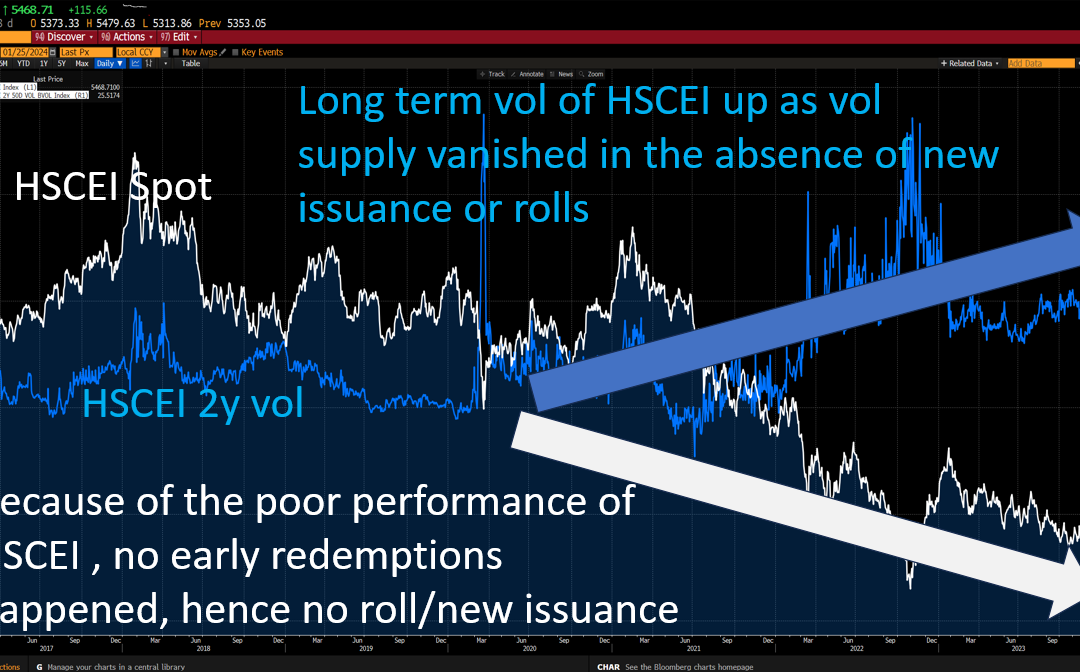

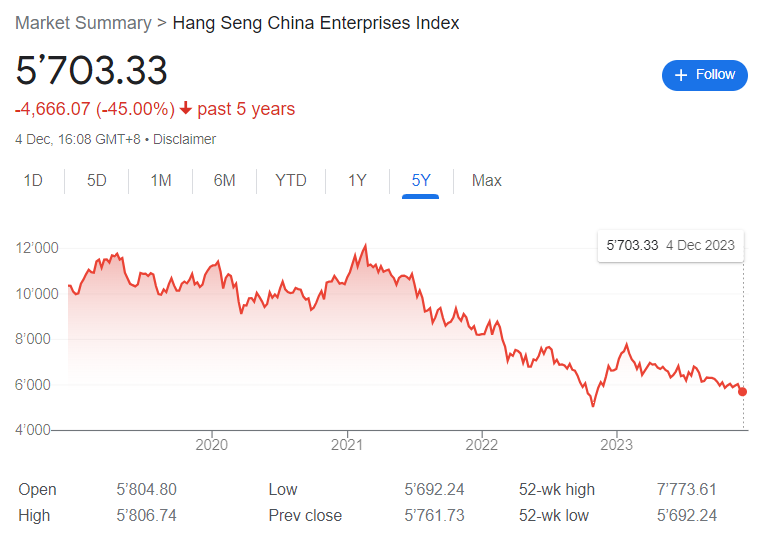

In the world of structured products, and as mentionned in a previous post, 2024 will be an extraordinary year in South Korea as 74% of the inventory (of $15billion) of Worst-of Index Autocallables are set to expire this year. The poor performance of the Hang Seng...

by ericbarthe | Jan 10, 2024 | Derivatives Theory and Practise, Markets, Products

South Korea is an extremely large market for structured products. A favourite product is the autocall on the worst of HSCEI and other other indices (S&P500, STOXX50E, Kospi etc..). The total live size of that best seller is around $20billion and $15billion of that...

by ericbarthe | Dec 4, 2023 | Markets, Products

… a reminder that potential risks can become a reality. According to The Korea Times, South Korea’s Financial Supervisory Service is getting worried that autocallables were mis-sold to retail investors as they are facing potential $billions in losses, due...