The rush into Chinese equities has propelled the 𝗛𝗮𝗻𝗴 𝗦𝗲𝗻𝗴 𝗜𝗻𝗱𝗲𝘅 𝗯𝘆 +𝟯𝟱% over the last month!

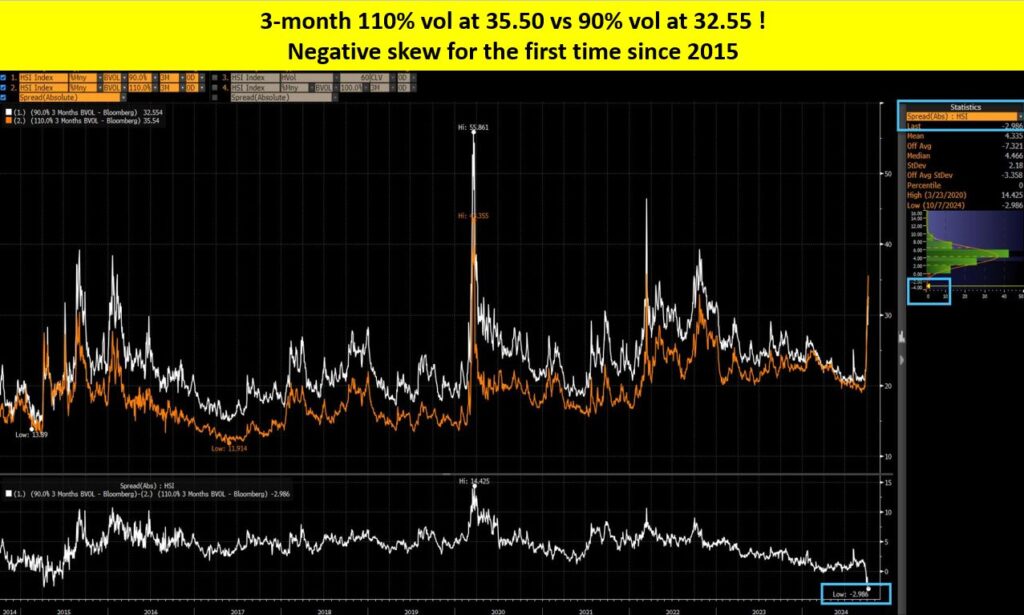

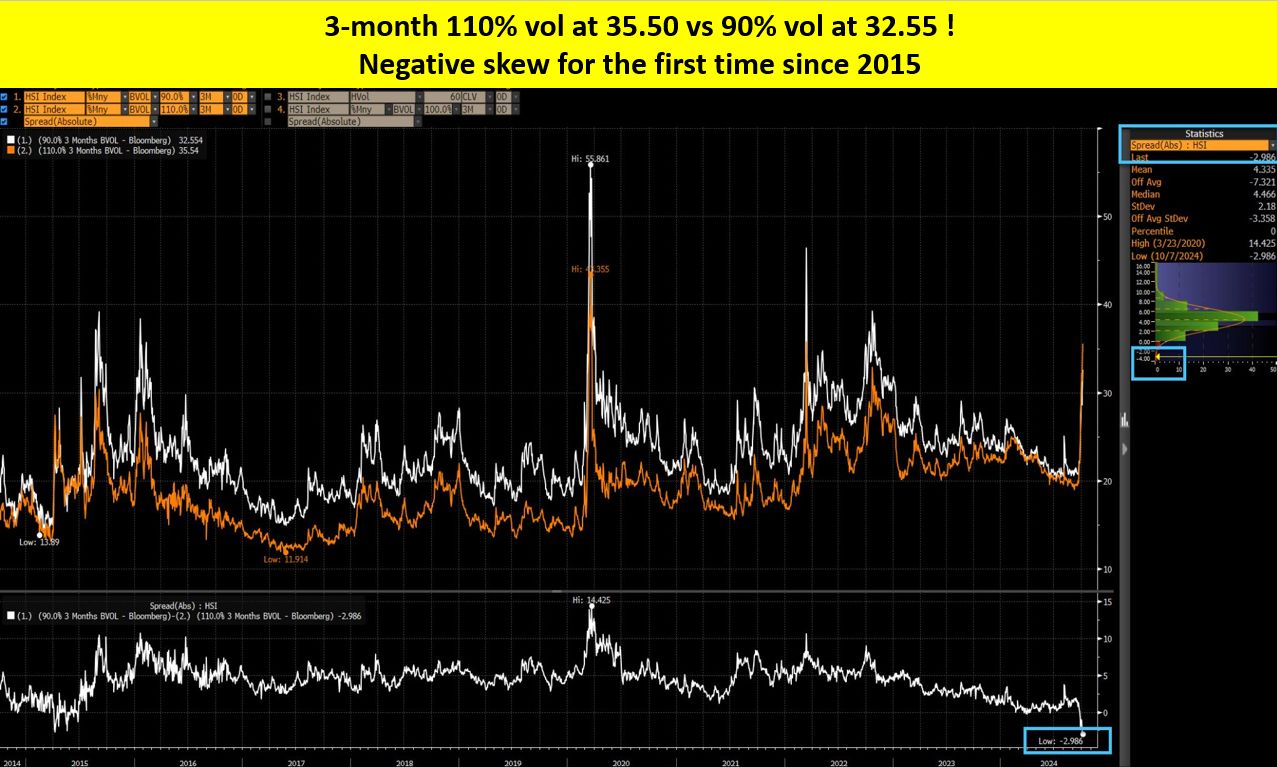

𝗧𝗵𝗮𝘁 𝗿𝘂𝘀𝗵 𝗺𝗮𝗻𝗶𝗳𝗲𝘀𝘁𝘀 𝗶𝘁𝘀𝗲𝗹𝗳 𝗮𝗹𝘀𝗼 𝗶𝗻 𝘁𝗵𝗲 𝗱𝗲𝗿𝗶𝘃𝗮𝘁𝗶𝘃𝗲𝘀 𝗺𝗮𝗿𝗸𝗲𝘁 where investors are bidding up the upside calls, leading to the very unusual situation where the 3-month 110% calls are now priced with an implied vol 3 points higher than the 90% put. The skew is negative!

That situation is rare: usually investors tend to overpay for the puts rather than for the calls. In other words, today, investors that are willing to give away Chinese upside will be highly compensated for it.

Good time for call overwriting or 1×2 call spread.

In exotic options space: Up and Out Calls are now particularly cheap versus Vanilla calls.

That’s a free trade idea!