In the world of structured products, and as mentionned in a previous post, 2024 will be an extraordinary year in South Korea as 74% of the inventory (of $15billion) of Worst-of Index Autocallables are set to expire this year. The poor performance of the Hang Seng China Enterprise Index (HSCEI) over the last years means that most autocalls will go until expiry this year and are around the barrier level now. At the aggregate level there is a $5billion digital in the market on. (in fact, there are plenty of smaller digital on different maturities and strikes, but for explanatory purposes, I aggregate them into one)

Impact of HSCEI autocallables on long term volatility

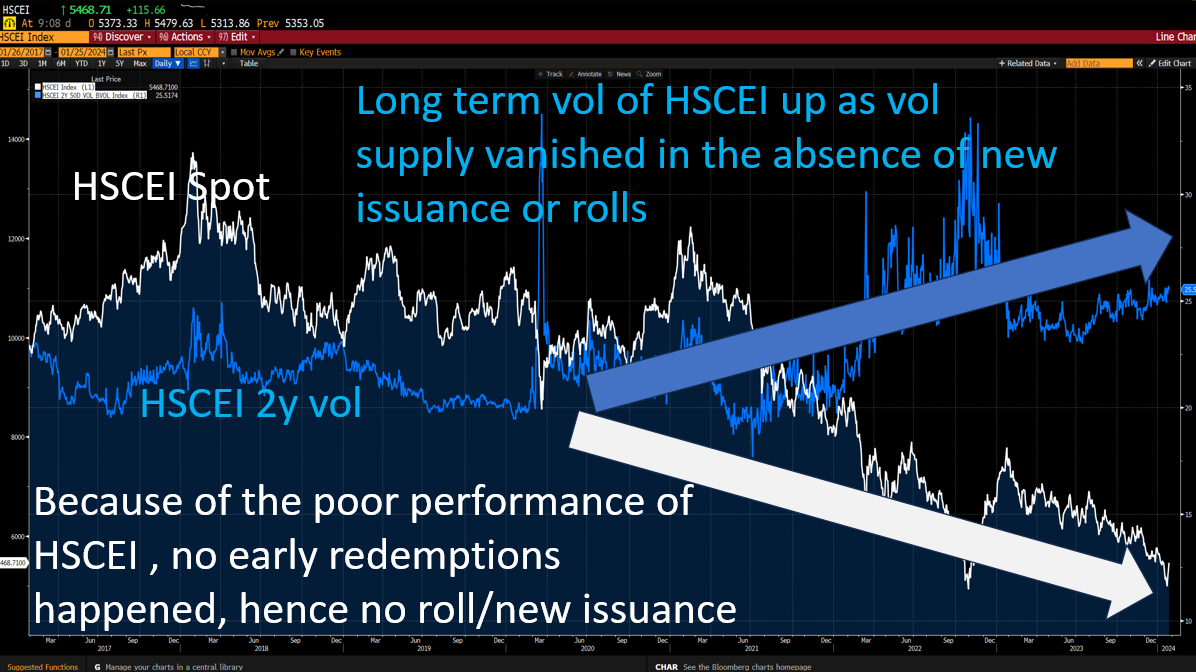

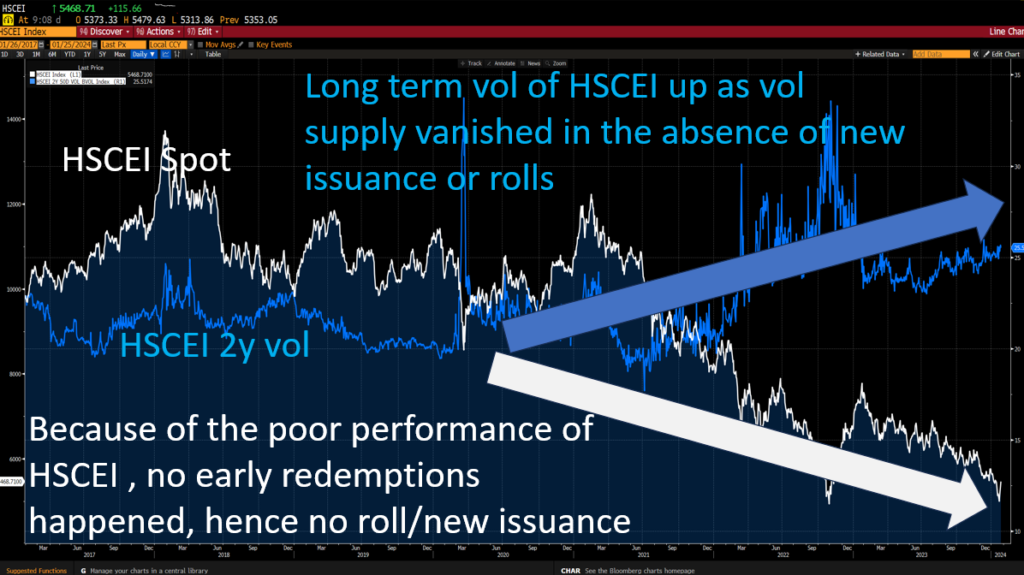

Due to the poor performance of HSCEI in the past years, autocalls have not early redeemed and so have not been rolled. So no new issuance has really happened, and as a consequence the long-dated part of the vol curve is not being offered so much any more by the dealers. Long dated vol is “free” again, free from the structured products flow. And indeed the long end of the curve has been going up steadily, and will probably continue to do so. (see graph 1)

It would come under pressure again if the redemptions of 2024 would be rolled into new HSCEI-based products, but given the performance of the past products, one can doubt that investors will touch those products again.

Impact of HSCEI autocallables on short term volatility

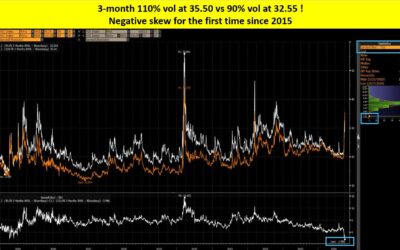

The very short end of the vol is affected by that huge digital (market is long a digital put). It seems that we are now below the aggregate strike of that digital, the short gamma is on the upside and the short term upside vol is well bid compared to 6 months ago, leading to a very smiley vol!

The situation in South Korea is stressful for investors, regulators, distributors and hedgers. Only the short term vol has good reasons to smile…