A single-stock exotic trader who sells structured products is essentially in the business of buying puts and worst-of puts on some of the most popular names in the market. For years now, these names have included Amazon, Meta, Apple, Google, Tesla, Nvidia, and more. Beyond tech, client interest often extends to pharma stocks (Eli Lilly, Johnson & Johnson), oil companies (Exxon, Chevron), and financials (Wells Fargo, JPMorgan, Goldman Sachs). The result? Exotic traders are regularly buying vega across dozens—sometimes hundreds—of names, with a strong concentration on Tech names.

Managing this vega risk can be tedious and costly. One approach is to hedge each name individually, rebalancing as prices move. However, with 100+ lines and often wide bid/ask spreads on single-name volatilities, this can quickly become cumbersome.

A more efficient solution is to macro hedge—selling S&P 500 volatility against the single-name vol exposure. This creates a classic “long dispersion” position: long vol on individual stocks (once again mainly Tech) and short vol on the index.

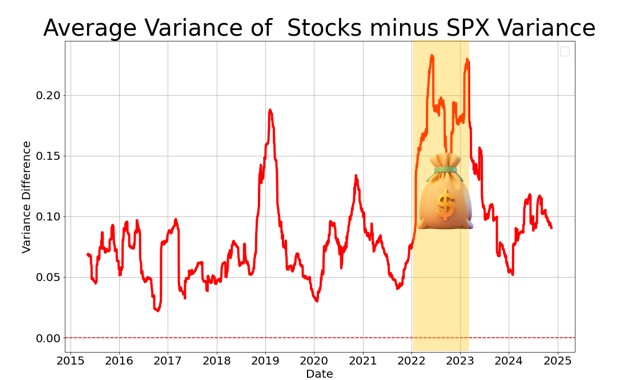

The performance of this position depends on sizing, entry points, and market paths. Nevertheless, comparing realized variances between top stocks and SPX gives a good idea about the performance of that position. (see graph below)

Take 2022: a dream year for that position! The SPX trended lower at relatively low volatility, while single names experienced significant moves. Meta dropped 25% in a single day in October, while Google shed 45% over the year. What a blast it was for the long dispersion position!

Since then? Meh.