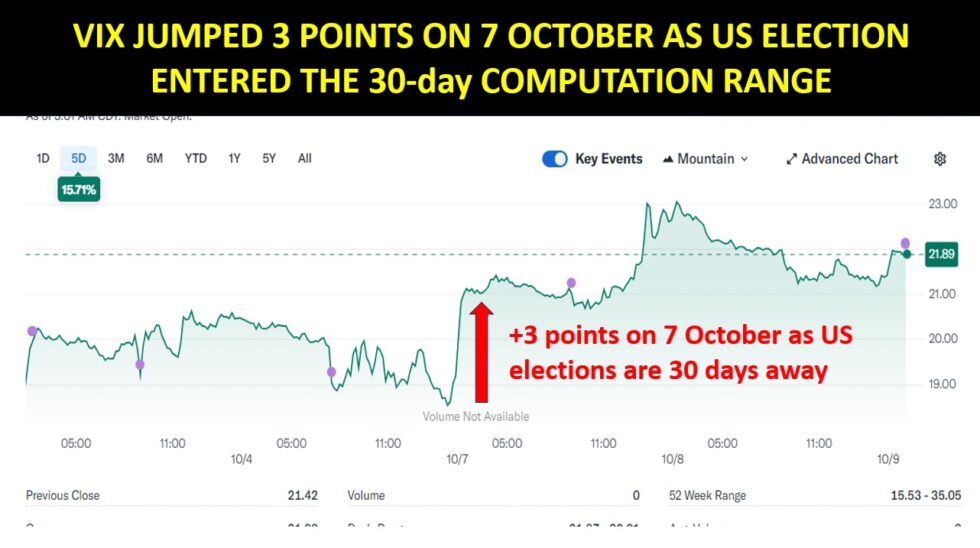

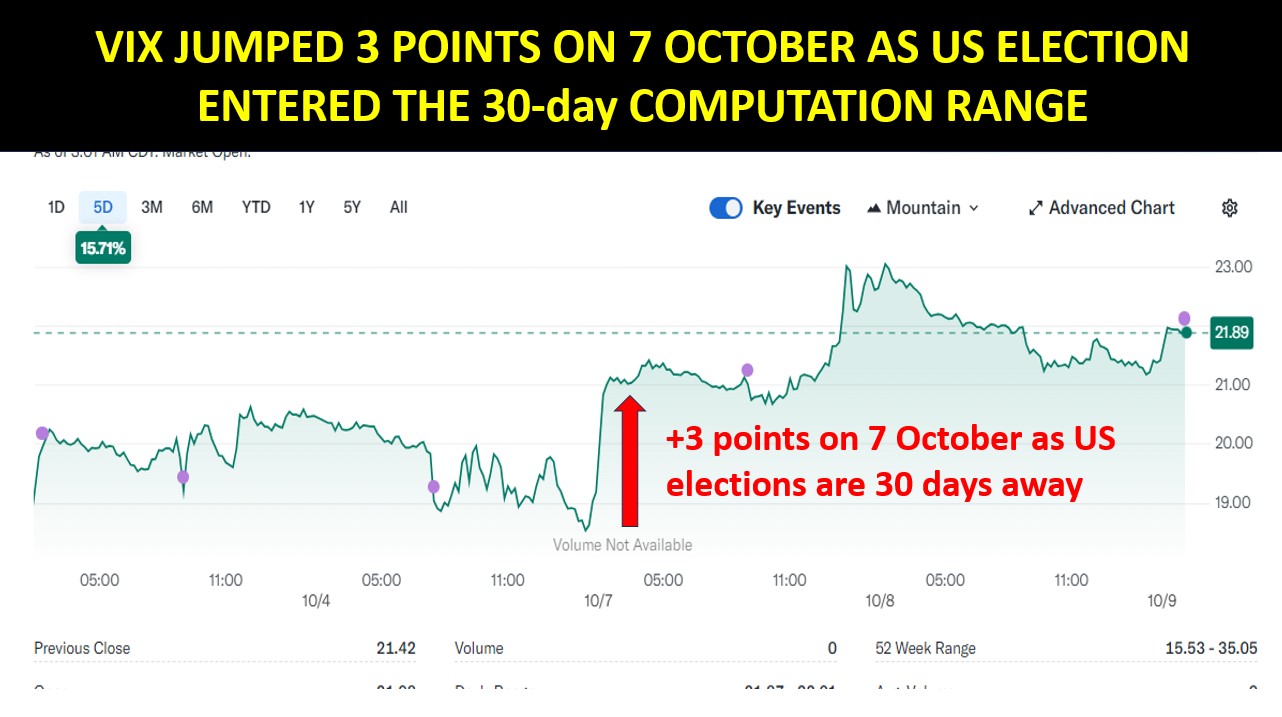

On Monday, October 7, the 𝗩𝗜𝗫 𝗷𝘂𝗺𝗽𝗲𝗱 𝗯𝘆 𝟯 𝗽𝗼𝗶𝗻𝘁𝘀, seemingly without cause. However, the reason is purely ‘technical’: VIX is short-sighted, only factoring in the next 30 days. On October 7, for the first time, the VIX’s calculation began to include November 6, 2024 — the day after the U.S. presidential election — explaining the sudden jump in volatility expectations.

Looking at the option market, SPX 5Nov24 expiries are priced at 14 vol whereas the 6Nov24 are priced at 16/17, which implies a 43/53 forward 1-day vol for the 6Nov24.

Traders are pricing options with the expectation that on November 6, 2024, the U.S. equity market will experience volatility three times higher than usual, anticipating a price swing of ±3.00% on that day.