Being a structurer is a great job: it means coming with payoffs or themes that make sense, that are attractive and that are friendly to the traders. It means mastering pricing models, hedging methods and also marketing since at the end a structurer has two “clients” to convince: the investor and the trader.

The Nestlé, Roche, Novartis combination is a Swiss favourite.

Being a structurer in Switzerland also means taking the tram or the train in Geneva or Zurich, along with a salesperson, proudly carrying the latest pitch book on a crisp morning. Explaining the most recent trade ideas, the newest payoffs and showing off the bank’s capacity in coming up with quantitative strategies. Then comes the next day, when the salesperson proudly announces “Thank you very much Eric, the client really enjoyed the presentation but he is asking simply for an autocall on Nestlé, Roche, Novartis. He has been doing that for the last 20 years and is not planning to change”

That’s the Swiss curse.

Swiss structured products investors seem addicted to the autocallable on the worst of Nestlé Roche Novartis. It is the bread and butter of any Swiss issuer, the top seller, one of the few products that is systematically issued every week by all Swiss banks. Nestlé, Roche and Novartis being the largest Swiss market caps (they make 50% of the SMI) but is there anything else that can explain that addiction. When you look at stats… there is something else. There is actually a Swiss blessing here!

The Nestlé Roche Novartis combination exhibits spectacular backtest

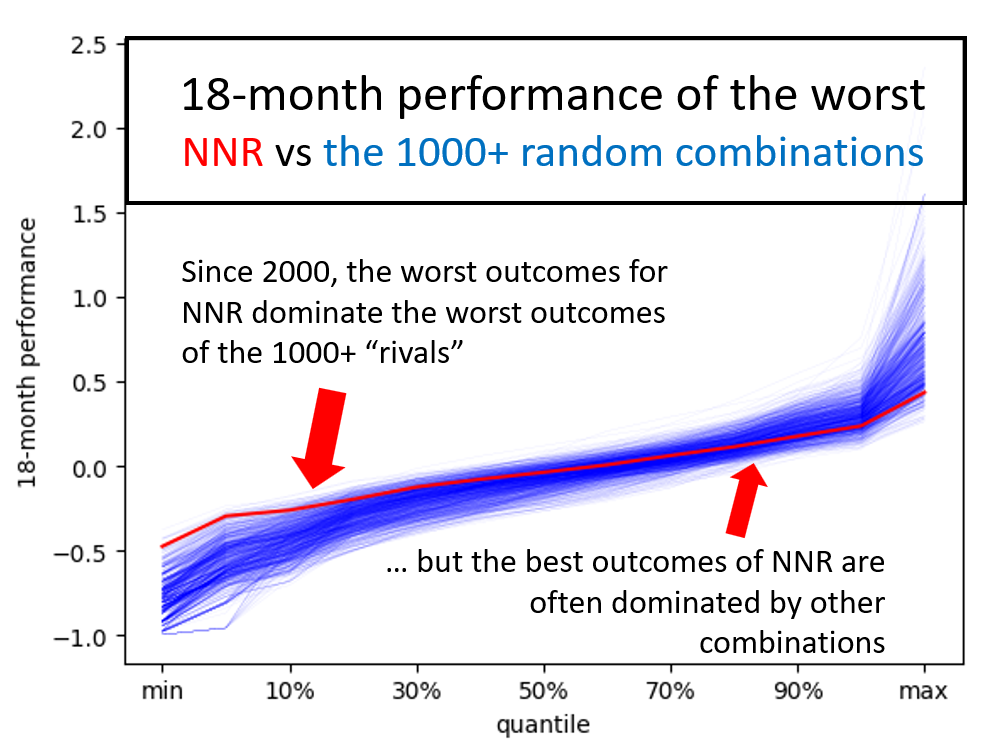

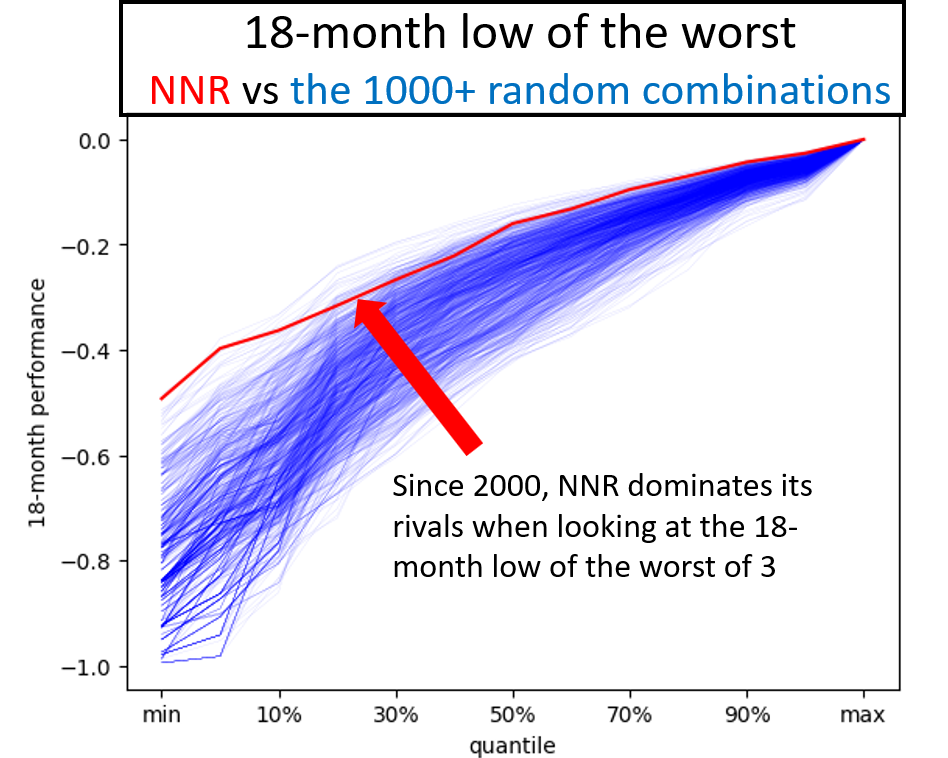

Take the 100 largest market caps in the US, and randomly make 500 combinations of 3 stocks. Do the same with european stocks, and the same with Swiss stocks. You now have more than 1000 combinations of 3 stocks global. How does Nestlé, Roche, Novartis (NRN) compare to all those “rivals” since 2000?

How does the distribution of the worst look if you consider 18-month performance ? NRN stands out. The worst outcome of the worst of NNR dominates all its rivals: it is historically safe to sell a worst of put on NNR. On the other hand, the best outcome of the worst of NNR is weak versus the rivals: buying a worst of call on NNR seems like a waste of money.

What about the 18-month low (of the worst)? Here again NNR dominates outrageously.

As long as Nestlé, Roche and Novartis continue to behave that way, the job of a structurer in Switzerland is not about to change !