The South Korean Financial Supervisor has issued a warning in a report published recently: around $850 million notional of autocalls are at the barrier level! Those products are usually indexed on the worst of S&P 500, Eurostoxx 50, Kospi, and Hang Seng China Enterprise Index (HSCEI) and exhibit a step-down autocall feature, with the last autocall trigger being at 50%-60% of the initial level, which also corresponds to the final barrier level.

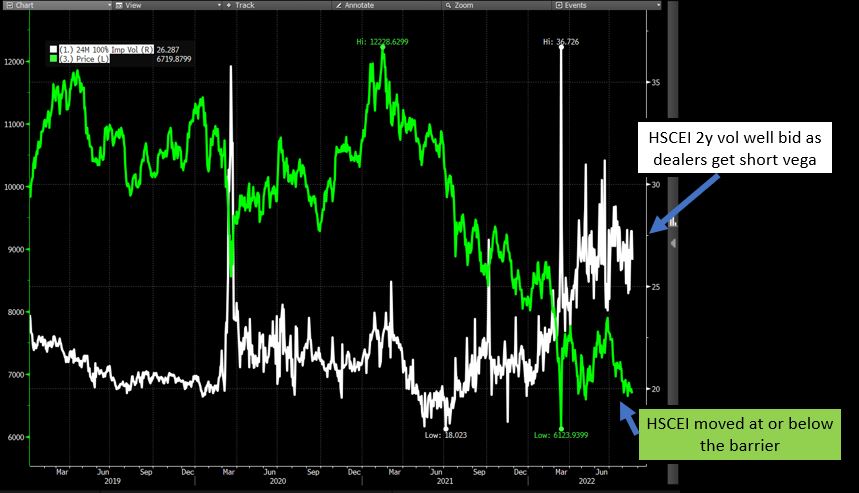

Given the poor performance of HSCEI, that index is the driver of the performance and the final payoff. At the end of Q3 2022, HSCEI was at or below the final barrier level. Most of those products will mature in 2024. In other words, if HSCEI rises from here by 2024, investors may recover their initial investments plus coupons. However, if HSCEI declines further, investors will lose 50% or more of their initial investment.

That means that approximately $0.5 billion of retail investors’ money is at risk at these levels. It also implies that there is a cumulative digital exposure of $0.5 billion on banks’ books—essentially a short skew position on HSCEI and a short forward. As the structures became short vega (for dealers), the 2-year volatility has reset to higher levels. If HSCEI remains at this level, we can expect skew distortion and substantial effects on dividends and repo, as the delta increases. As time to maturity decreases, we may witness significant gamma swings around the barrier level.

For everyone—investors and traders—let’s hope that the HSCEI Index recovers by 2024!