???? Citi has been named Equity Derivatives House of the year 2023 by Risk.net . In particular, Citi was rewarded for its success in marketing the Volatility Knock-Out Puts (VKO Puts). I have mentioned (and praised) those instruments many times in the past and never got tired of it, despite the relative skepticism of some of my interlocutors who may now read me with a regretful tear in their eyes.

????As a reminder, a typical VKO put would be a 100% or 95% strike put on S&P500, maturity 12 months, that knocks out if the realised vol of S&P500 over the life of the put is greater than a certain threshold (typically 30). At the end of 2021, S&P500 vol was low but the skew was high. The discount that a VKO Put would then offer versus the vanilla put was extreme. That’s the ????????????????????????????.

Citi say that it was their 2022 view that the equity markets would correct because of the inflation concerns but at a slow pace, given the deleveraging of hedge funds. In other words, they would predict a market correction but a low realised volatility. That’s the ????????????????.

The art of structuring is to find the most efficient ???????????????????????????? to express a specific ????????????????.

In 2022, the view was perfectly realised and the VKO put was the piece of art of 2022.

????According to Risk.net, Citi sold $30billion of that beauty. The impact on the volatility market is not to be neglected and to me is a major contributor to the death of S&P500 skew in 2022.

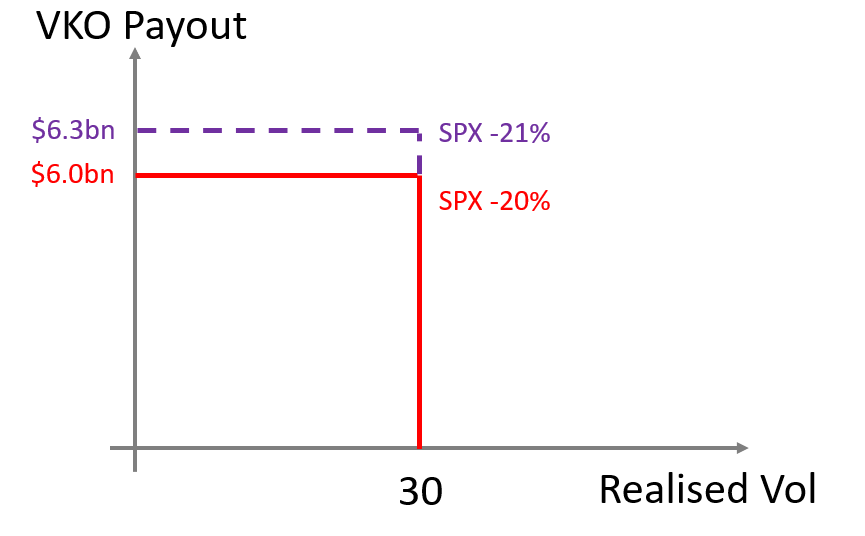

Here is why: back of the enveloppe, the S&P500 was down circa 20%, so with strikes at 100% or 95% it means $4-6bn of intrinsic value for those puts (Citi only).

if Realised vol of S&P500 is below 30, the liability of the bank is $4-6bn. If Realised vol of S&P500 is above 30, the liability is 0. That’s a massive vega position (and skew of vol..).

Moreover, for each 1% move down on S&P500, the difference of liability increases by $300mio (1%*30bn). That’s a massive skew/vanna position that traders accumulated by selling VKOs.

As a result, as the market was going down, the street was getting longer gamma/vega, putting pressure on the realised volatility… as with a self-fulfilling prophecy, the massive presence of the ???????????????????????????? in the market reinforced the realisation of the ????????????????.

????For sure, it made the modeling and the hedging of the VKOs particularly challenging, where the feedback effect of hedging on market dynamics was a key component. The fact that those trades seemed to have been profitable both for the clients and the bank is remarkable. ???????????????????????????????????? ???????????????????????????????????????????? ???????? ???????????? ????????????????!