Is accumulating post-nominal letters a sign of a competence? or a promise for future underperformance ?

Regarding people, I cannot answer.

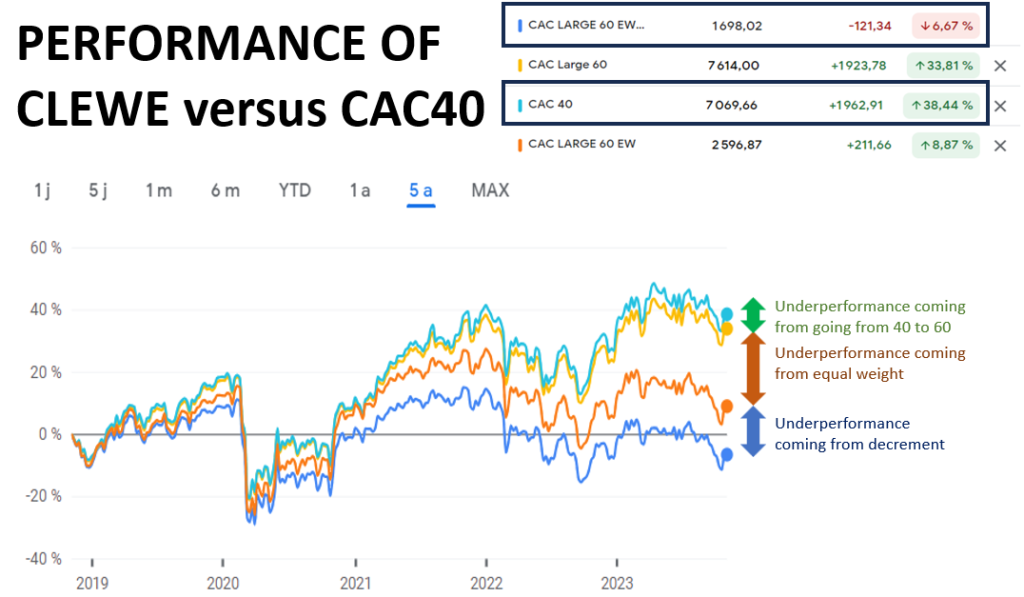

Regarding Equity Indices… let’s take a look at a big commercial success: 𝗖𝗟𝗘𝗪𝗘 Index or the 𝗖𝗔𝗖 𝗟𝗔𝗥𝗚𝗘 𝟲𝟬 𝗘𝗪 𝗘𝗥. It is much more than the French CAC, it has 𝗟𝗔𝗥𝗚𝗘 𝟲𝟬, it has 𝗘𝗪, it has 𝗘𝗥. And if it were totally immodest, it would also display its 𝟱% 𝗗𝗲𝗰𝗿𝗲𝗺𝗲𝗻𝘁 medal.

That index was a best seller as an underlying to Autocallables and is a case-in-point of how decrement indices are sometimes created, and how it affects their performance. Let’s look at each of its “medals” and how it makes it different from the usual French CAC40 Equity Index.

𝗟𝗔𝗥𝗚𝗘 𝟲𝟬: it takes the 60 largest market caps, instead of the largest 40. Why doing that? 1/ It creates an index that is slightly more volatile (because the next 20 caps are smaller that the first 40 and usually smaller caps are more volatile than larger market caps). More volatility means a higher put price, so higher coupons. 2/at the time of the index creation, smaller market caps tended to outperform larger caps (size factor) so the CAC Large 60 would exhibit a better past performance than the CAC40. Now things have changed…. 𝗨𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗼𝘃𝗲𝗿 𝟱 𝘆𝗲𝗮𝗿𝘀: -𝟰.𝟴𝟬%

𝗘𝗪: stands for equally weighting. It exacerbates the previous effect: more volatility and more past performance (at the time). But when the size factor does not perform, it is very costly… 𝗨𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗼𝘃𝗲𝗿 𝟱 𝘆𝗲𝗮𝗿𝘀: -𝟮𝟱%

𝗘𝗥: excess return. The perf of that index is reduced every day by the Euro overnight interest rate. The effect is that it reduces the forward of the index so makes the price of the put higher, so the coupons higher. In times of zero interest rates, it does not affect the performance, But today, the overnight euro rate is 3.90%… 𝗙𝘂𝘁𝘂𝗿𝗲 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 : -𝟯.𝟵𝟬% 𝗽𝗲𝗿 𝗮𝗻𝗻𝘂𝗺

𝟱% 𝗗𝗲𝗰𝗿𝗲𝗺𝗲𝗻𝘁: that one is not displayed but it is in the index description. It removes most the dividend risk for the bank, and also increases the coupons/lowers the barrier. Given that the realised dividend yield of the index is below 5%, that is a source of underperformance.

𝗨𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲 𝗼𝘃𝗲𝗿 𝟱 𝘆𝗲𝗮𝗿𝘀: -𝟭𝟱.𝟱𝟰%

So how did CLEWE perform over the last 5 years?

-6.67%. Not bad. but CAC was up +38.44% at the same time.

Autocallables investors are safe.

BUT

All the medals mattered in the higher coupons CLEWE offered, but it also mattered in its performance. Simple.

???????????????? ???????????? ???????????????????? ???????????? ????????????????.