Yield enhancement products have been the market favourite for years

The most actively traded retail structured products for decades have been yield enhancement products (autocallables, barrier reverse convertible, reverse etc.). They regularly accounted for more than 75% of the total issuance of structured products.

The principle of those products is simple. You enhance the yield of a vanilla bond by taking more risks in the form of the sell of a Knock-In put on equities. Back in the days where bond yields were say 1%, selling a deep OTM put for say 3% was a significant yield enhancer ( x4 in the example). That came at the expense of liquidity a the investor in practice would be stuck in the product for the full maturity of the structured product. The enhancement level depends on the level of implied volatility compared to existing bond yields. Even though implied volatilities have been quite muted for years now (ex Covid), the bond yields were so low that selling vol was still “worth it”.

Current short-term USD interest rates make yield enhancement a bit nonsensical

Today a USD investor can invest at 5% per annum, short term in perfectly liquid instruments. So is it worth doing yield enhancement? ???????????????????? ????????????.

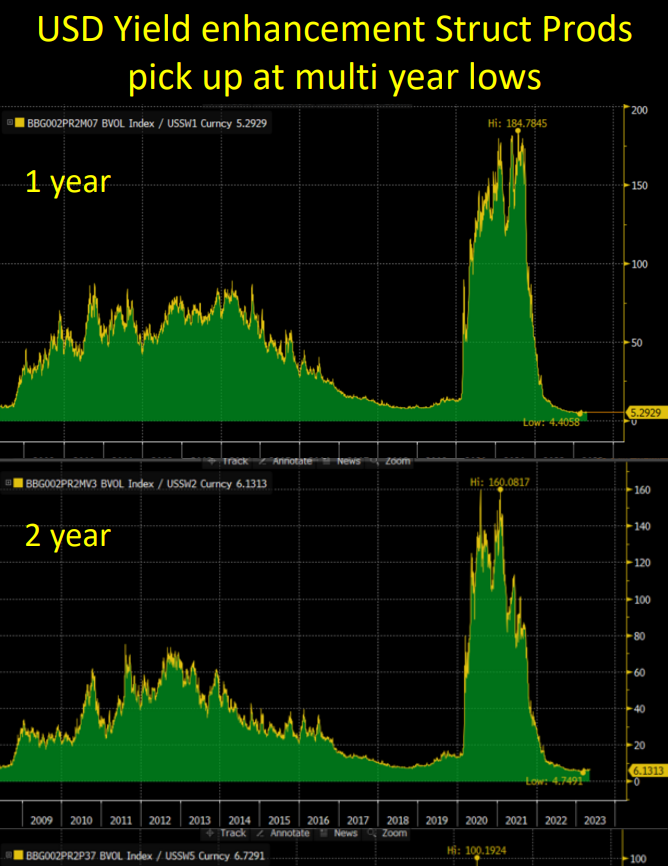

Take the 80% strike index volatilities as benchmark for the pick up that selling puts provide. Look at the ratio of that implied vol over the USD yield for 1, 2 or 5 years maturities. The ratio is at multi-year lows, meaning that the relative pick up is particularly unattractive, the times seem particularly bad for such trades.

Clearly the environment is currently not favourable for yield enhancement structured products.

In the silk sheet of time, SP investors will find peace of mind, but for now yield is a bed full of blues.

Note: I use USD flat and EUR+75 for the sake of computing the ratios below.