By now, most Swiss wealth managers will have received offers on so called “Outperformance Certificates” from banks. This is a classic of the Swiss structured products. They are usually 6-month product that make the most of the Swiss stocks who generally:

- Have a low implied vol

- Have a high dividend yield

- Pay the annual dividend in one shot (unlike US stocks ), usually in H1.

As a result the 6-month ATMS calls are very cheap (in premium terms) compared to the ATMS puts. The sell of one put can finance the purchase of 1, 2 or more calls and creates a product where “the upside is more than the downside”, hence the name “outperformance” certificate.

Favourites for those trades are Insurance stocks and their high dividends (and low vol). For instance, the shares of Zurich insurance are expected to pay a dividend of 5% in April 2023. The 6-month ATMS is worth 3.00% but the 6-month ATMS put is worth 7.00%. With 6-month CHF interest rates at 1.20%, for zero fee and a total costs of 100%, one can structure an outperformance certificate as :

Long One Zero Coupon Bond ( costs 99.40% )

Short 1x ATMS Put (brings 7.00%)

Long 2.5x ATMS Call (costs 2.5*3.00% = 7.60%)

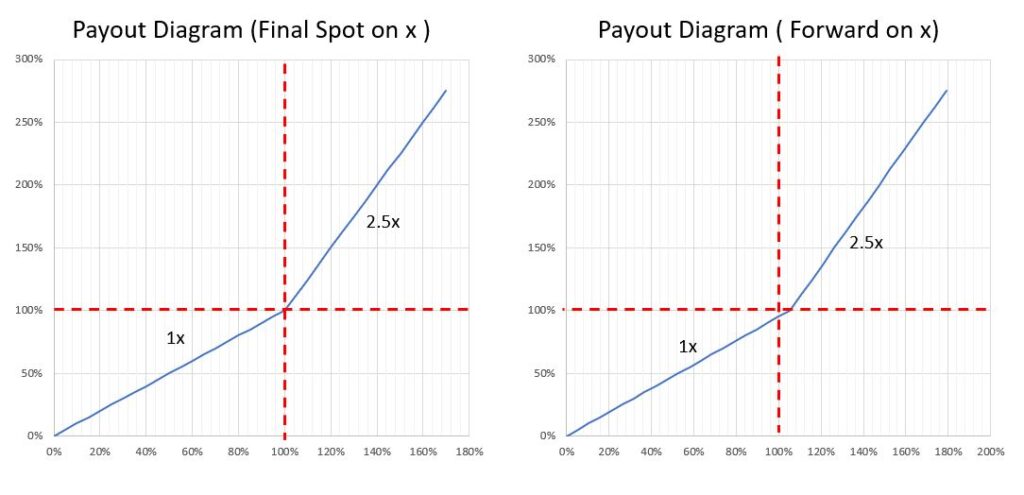

That’s quite attractive to investors bullish on the stock (see graph below). Compared to a direct investment in the stock, the investor forfeits the dividend (a hefty 5% on our case), takes the issuing bank credit risk and sacrifices liquidity. The impact of the fee on such structures is heavy too: here the call option is worth 3.00%. A 1% fee would mean forfeiting a third of the optionality !

Although the final payout is easy to grasp, the initial delta is often a source of surprise for investors. In our example, some would expect the product to gain 2.50% if the stock goes up +1% (there is 2.5x upside!), but probably to lose only 1% if the stock is down 1% (there is only 1x downside)! A constantly asymmetric delta is a holy grail I am still looking for..

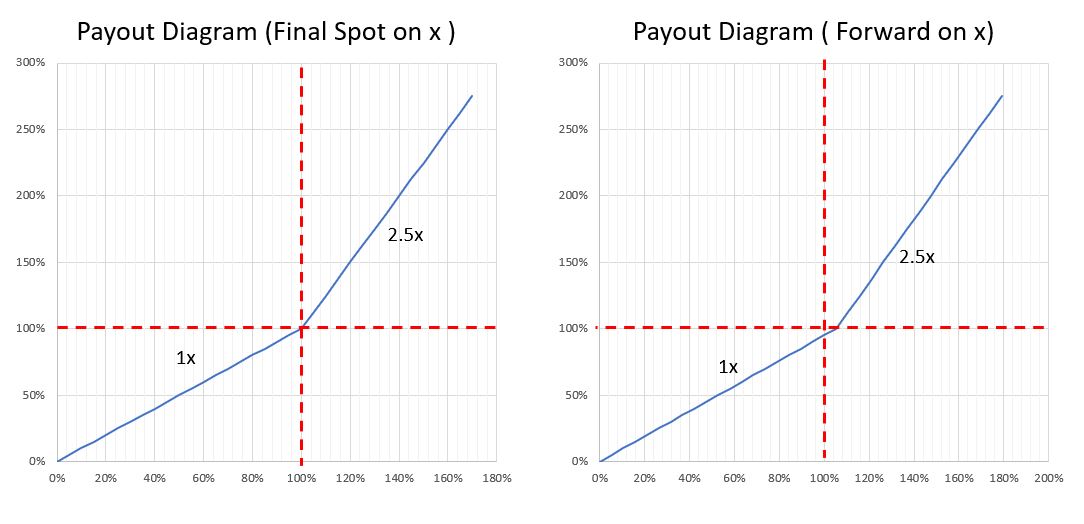

The delta of such structure is 156% (less than the average of 1x and 2.5x which would give 175%). So if the stock initially gains 1%, the product will gain 1.5%, but if the stock moves down by 1%, the product will lose 1.50%. To get the right feeling about delta, it is always useful to plot the payoff diagram in the forward space rather than the spot space, and see that forward “sits” on the 1x slope more than on the 2.5x slope, hence a delta lower than 175%.