The industry practise is to build BRCs or autocallables on the worst of 3 assets. Rarely do we see worst of 2. But it is not uncommon to see investors going for worst of 4 or worst of 5 (especially on indices) to extract more yield. A question worth asking is whether there is an optimal number of assets. Is it really worth adding a 4th or 5th asset? How much does it bring?

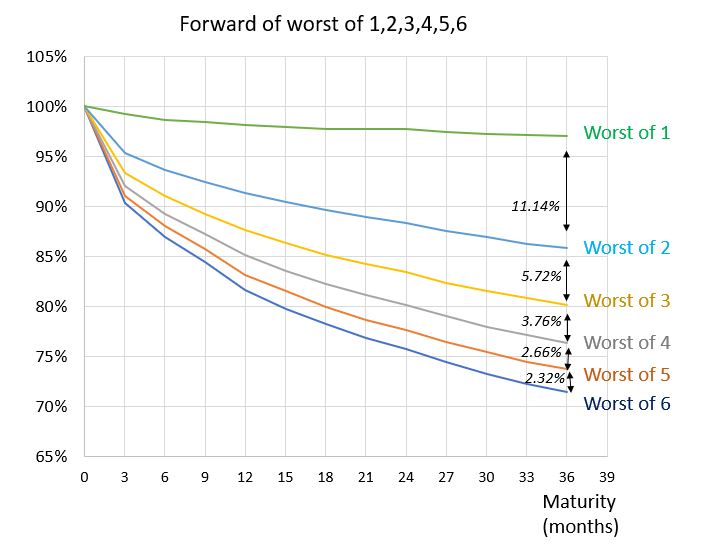

Obviously, the answer may differ if the additional stock is more or less volatile or correlated with the others. To isolate the pure “number” effect, we create dummy assets that have exactly the same volatility surface and that have the same pairwise correlation of 70%. We then price the discounted forward for the worst of 1, worst of 2, worst of 3 …until worst of 6 and look at the discount that each additional asset brings (in local vol).

Looking at 36-month maturity, worst of 2 brings 11.14% discount versus a single underlying. Worst of 3 brings 5.72% discount versus Worst of 2, then 3.76%, 2.66%, 2.32%.. As the number of assets increase, the additional discount decreases sharply. Looking at this, going for worst of 5 seems to be adding too much risk for the discount it gives. Worst of 3 or 4 seems to be a good standard! Going for more does not seem to bring good value.